Question: if youre able to explain please do so The following exam is to test the student's understanding of the information covered in chapters 1-3 in

if youre able to explain please do so

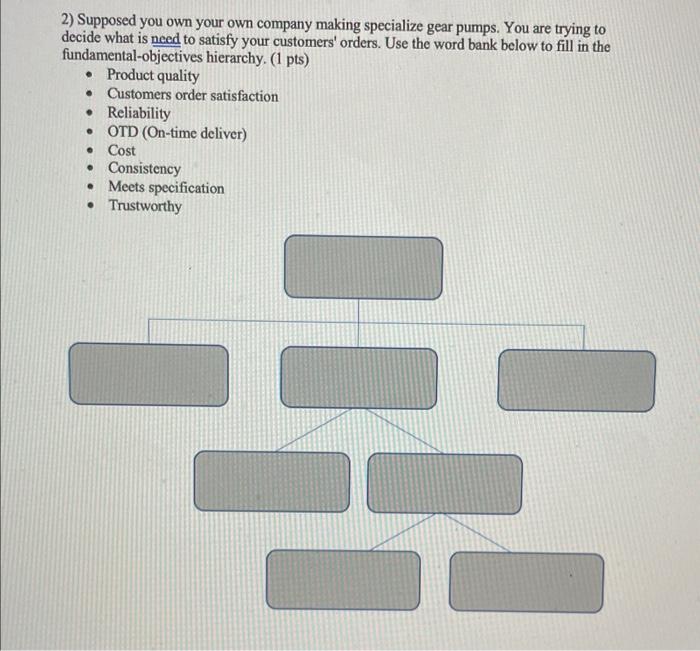

The following exam is to test the student's understanding of the information covered in chapters 1-3 in the coursebook. This test is to be worked on independently; however, the study can use the coursebook and past homework assignments. Exam c.1e is worth 12 pts or 12% of your final grade. Please read the questions fully and show as much work as possible to gain partial points to obtain maximum points. If a question needs more clarity, email me. 1) NC A\&T would like to know their net present value of cash flow if they invest $250,000 today on new housing. With an initial investment of $175,000 for a 5 years' time, expecting the rate of return is 10% yearly. ( 2 pts) A) What is the NPV. B) Is this a good investment 2) Supposed you own your own company making specialize gear pumps. You are trying to decide what is need to satisfy your customers' orders. Use the word bank below to fill in the fundamental-objectives hierarchy. (1 pts) - Product quality - Customers order satisfaction - Reliability - OTD (On-time deliver) - Cost - Consistency - Meets specification - Trustworthy 3) You work for a small company, and COVID has significantly impacted your company's sales. The lack of capital has forced you and your company to look for other payment options. For example, your depart is in desperate need of some new computers. A local Dell representative offers the following: For ten computers, the cost will be $26,000, with an interest rate of 10%. It will come to $260 for a 1-year loan. Thus, the total price is $26,260, and you can pay it off in 12 installments of $2,188.33 each month. Use the interest rate of 10% per year to calculate the net present value of the loan. (Remember to convert to a monthly interest rate.) Based on this interest rate, should you accept the terms of the loan? ( 2pts ) 4) Refer back to the Rice football dilemma from question 1.7. The school board was faced with a tough decision to reduce Rice's football team's $4 million and growing deficit. The school had three choices: increase ticket earnings, obtain money from non-athletic sources, and/or move NCAA (National Collegiate Athletics Association) division. Each choice had its own outcome. When looking at increased ticket earnings, the school can increase the price of tickets (resulting in fewer people attending games). Or they can devise a way to get more people at games. However, increasing. Option two, obtaining money from nonathletic sources, can be done through alumni donations, licensing/merchandise, and rising tuition. Rising tuition and also make the school too expensive for some students. The last option could be to move football division. Conversely, this could cause a decrease in support from fans, supporters, and alumni. ( 2 pts) *ute that this question is a summary of question 1.7. There are some minor changes and additions, so answer the following question based on the summary provided above and not the book A) What is the fundamental objective? B) Draw the decision tree 5) What is the present value of the following? (1pts) a) $12,500 dollars promised at the end of 8 years is with 12% interest b) $50,000 dollars promised at the end of 30 years is with 5% interest