Question: if you're not going to answer all questions dont do it please. show work please. FINC 326: Cumulative Assignment Part 3 Please show the formula

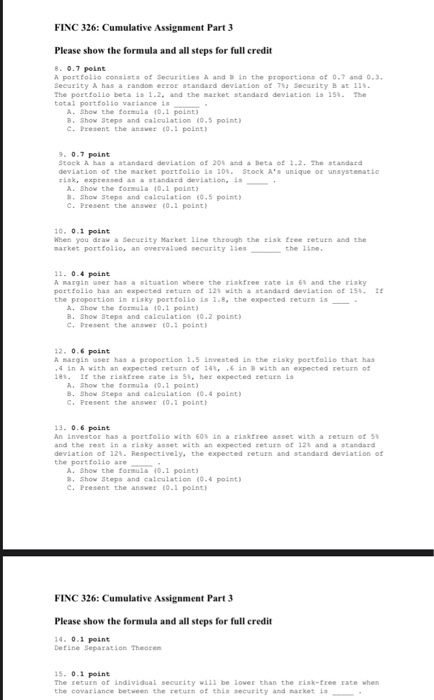

FINC 326: Cumulative Assignment Part 3 Please show the formula and all steps for full credit 8. 0.7 point A portfolio consists of Securities and in the proportions of 0.7 and 0.3. Security A has a random error standard deviation of 71: Security B at 111. The portfolio beta is 1.2, and the market standard deviation is 151. The total portfolio variance is A. Show the formula 10.1 point) 3. Show Steps and calculation (0.5 point) c. Present the answer (0.1 point) 9. 0.7 point Stock A has a standard deviation of 201 and a Beta o 1.2. The standard deviation of the market portfolio is 10%. Stock A's unique or unsystematic risk, expressed as standard deviation, is A. show the formula 10.1 point) 3. Show Steps and calculation (0.5 point) C. Present the answer (0.1 point) 0.1 point When you draw a Security Market line through the risk free return and the market portfolio, an overvalued security lies the line 11. 0.4 point A margin user has a situation where the riskfree rate is 65 and the risky portfolio has an expected return of 121 with a standard deviation of 15.1 the proportion in risky portfolio is 1.8, the expected return is A. Show the formula 10.1 point) B. Show Steps and calculation (0.2 point) c. Present the answer (0.1 point) 12. 0.6 point A margin user has a proportion 1.5 invested in the risky portfolio that has . 4 in A with an expected return of 141..6 in B with an expected return of 181. If the riskfree rate is 1. her expected return is A. show the formula 10.1 point) 3. Show Steps and calculation (0.4 point) C. Present the answer (0.1 point) 13. 0.6 point An investor has a portfolio with 60% in a riskfree asset with a return of 3 and the rest in a risky asset with an expected return of 126 and a standard deviation of 121. Respectively, the expected return and standard deviation of the portfolio are A. show the formula 10.1 point) 3. Show Steps and calculation (0.6 point) c. Present the answer (0.1 point) FINC 326: Cumulative Assignment Part 3 Please show the formula and all steps for full credit 14.0.1 point Define Separation Theorem 15. 0.1 point The return of individual security will be lower than the risk-free rate when the covariance between the return of this security and market is FINC 326: Cumulative Assignment Part 3 Please show the formula and all steps for full credit 8. 0.7 point A portfolio consists of Securities and in the proportions of 0.7 and 0.3. Security A has a random error standard deviation of 71: Security B at 111. The portfolio beta is 1.2, and the market standard deviation is 151. The total portfolio variance is A. Show the formula 10.1 point) 3. Show Steps and calculation (0.5 point) c. Present the answer (0.1 point) 9. 0.7 point Stock A has a standard deviation of 201 and a Beta o 1.2. The standard deviation of the market portfolio is 10%. Stock A's unique or unsystematic risk, expressed as standard deviation, is A. show the formula 10.1 point) 3. Show Steps and calculation (0.5 point) C. Present the answer (0.1 point) 0.1 point When you draw a Security Market line through the risk free return and the market portfolio, an overvalued security lies the line 11. 0.4 point A margin user has a situation where the riskfree rate is 65 and the risky portfolio has an expected return of 121 with a standard deviation of 15.1 the proportion in risky portfolio is 1.8, the expected return is A. Show the formula 10.1 point) B. Show Steps and calculation (0.2 point) c. Present the answer (0.1 point) 12. 0.6 point A margin user has a proportion 1.5 invested in the risky portfolio that has . 4 in A with an expected return of 141..6 in B with an expected return of 181. If the riskfree rate is 1. her expected return is A. show the formula 10.1 point) 3. Show Steps and calculation (0.4 point) C. Present the answer (0.1 point) 13. 0.6 point An investor has a portfolio with 60% in a riskfree asset with a return of 3 and the rest in a risky asset with an expected return of 126 and a standard deviation of 121. Respectively, the expected return and standard deviation of the portfolio are A. show the formula 10.1 point) 3. Show Steps and calculation (0.6 point) c. Present the answer (0.1 point) FINC 326: Cumulative Assignment Part 3 Please show the formula and all steps for full credit 14.0.1 point Define Separation Theorem 15. 0.1 point The return of individual security will be lower than the risk-free rate when the covariance between the return of this security and market is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts