Question: IFRS 15 Alignment Co. signed a contract to provide network service to Clumsy Ltd for one year from April 2018 for $100 per month. The

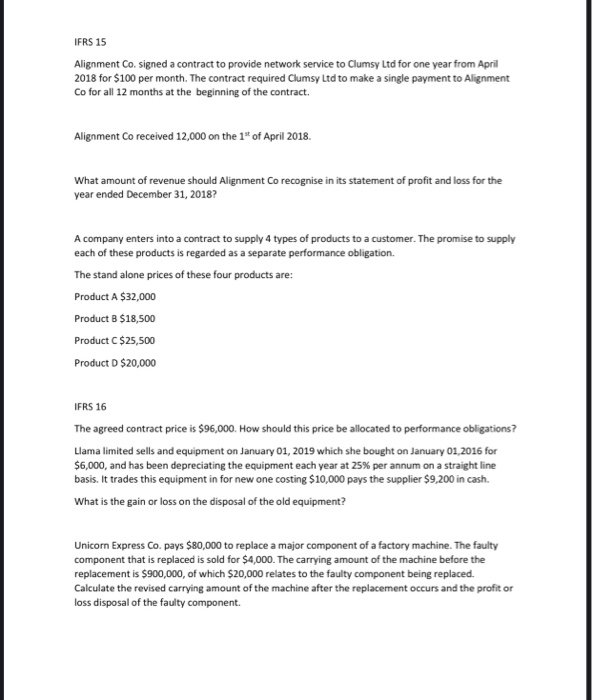

IFRS 15 Alignment Co. signed a contract to provide network service to Clumsy Ltd for one year from April 2018 for $100 per month. The contract required Clumsy Ltd to make a single payment to Alignment Co for all 12 months at the beginning of the contract. Alignment Co received 12,000 on the 1* of April 2018. What amount of revenue should Alignment Co recognise in its statement of profit and loss for the year ended December 31, 2018? A company enters into a contract to supply 4 types of products to a customer. The promise to supply each of these products is regarded as a separate performance obligation The stand alone prices of these four products are: Product A $32,000 Product B $18,500 Product C $25,500 Product D $20,000 IFRS 16 The agreed contract price is $96,000. How should this price be allocated to performance obligations? Llama limited sells and equipment on January 01, 2019 which she bought on January 01,2016 for $6,000, and has been depreciating the equipment each year at 25% per annum on a straight line basis. It trades this equipment in for new one costing $10,000 pays the supplier $9,200 in cash. What is the gain or loss on the disposal of the old equipment? Unicorn Express Co. pays $80,000 to replace a major component of a factory machine. The faulty component that is replaced is sold for $4,000. The carrying amount of the machine before the replacement is $900,000, of which $20,000 relates to the faulty component being replaced. Calculate the revised carrying amount of the machine after the replacement occurs and the profit or loss disposal of the faulty component

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts