Question: IFRS 16 Leases Basic + c deloitteifrslearning.com/media/modules/6b74a4ad/sco/story_html5.html IFRS 16 Leases Basic Deloitte. Q: Which of the following scenarios may lead to a lease being classified

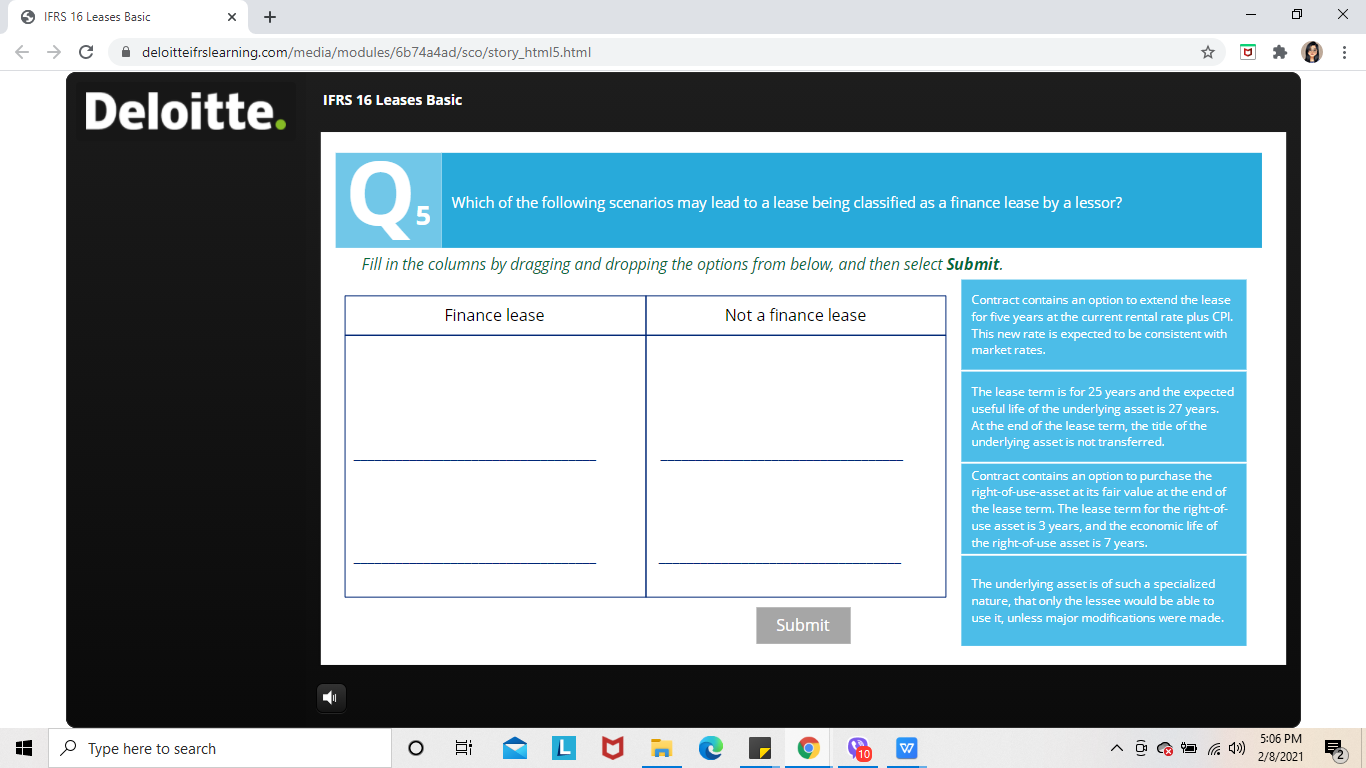

IFRS 16 Leases Basic + c deloitteifrslearning.com/media/modules/6b74a4ad/sco/story_html5.html IFRS 16 Leases Basic Deloitte. Q: Which of the following scenarios may lead to a lease being classified as a finance lease by a lessor? Fill in the columns by dragging and dropping the options from below, and then select Submit. Finance lease Not a finance lease Contract contains an option to extend the lease for five years at the current rental rate plus CPI. This new rate is expected to be consistent with market rates. The lease term is for 25 years and the expected useful life of the underlying asset is 27 years. At the end of the lease term, the title of the underlying asset is not transferred. Contract contains an option to purchase the right-of-use-asset at its fair value at the end of the lease term. The lease term for the right-of- use asset is 3 years, and the economic life of the right-of-use asset is 7 years. The underlying asset is of such a specialized nature, that only the lessee would be able to use it, unless major modifications were made. Submit :: Type here to search o a 5:06 PM 2/8/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts