Question: IFRS BASED You may use the following case study( if any information is required) CASE Study ADVENT plc (ADVENT) is a large, UK-based company which

IFRS BASED

You may use the following case study( if any information is required)

CASE Study

ADVENT plc (ADVENT) is a large, UK-based company which offers adventure travel and related services. ADVENT has a 31 December year-end and prepares its financial statements under UK-adopted IFRS. So far, it has been operating from its offices in the UK assisting UK customers in planning and organizing adventure trips to destinations all over the world. In the future, it intends to expand its operations internationally, i.e., to set up offices in other countries and to start serving non-UK customers. On 1 January 2022, to finance this expansion, the CEO of ADVENT succeeded in taking out a loan with a large UK bank, which has a reputation for building and maintaining long-term relationships with its clients. The loan makes up a significant amount of total assets and has a maturity of 15 years. The terms of the loan are as follows: o The loan principal is 25 million. o Arrangement fees were 250,000. o Interest is payable at 3% pa of the principal amount of the loan for the first 5 years rising to 5% pa for the remainder of the loan term. o The interest is payable annually in arrears on 1 January. o The loan will be repaid in full after 15 years. In addition, the CEO wants to list ADVENTs shares on the London Stock Exchange (LSE), in the Standard Segment of the Main Market. The CEO expects the process of listing to be quick and hassle-free but has to obtain approval from ADVENTs existing shareholders before he can initiate it. If approval is obtained, he wants to initiate the listing in 2023. Existing shareholders comprise a group of 30 individuals with relatively low stakes each, as well as a blockholder with a stake of 55% and a seat on the board of directors as a non-executive director (a blockholder is an investor who owns a large stake). The blockholder invested in ADVENT shortly after the incorporation of the company and pursues long-term interests; he has no intention to sell his stake anytime soon. The group of 30 individuals, on the other hand, invested in ADVENT at various points in time without any long-term interests; they saw in ADVENT a profitable investment opportunity and are ready to sell their shares as soon as their return is sufficiently high. The CEO does not expect to obtain shareholder approval without difficulties since he needs 75% of the voting rights in support of his proposal. Yet, he hopes to be able to convince existing shareholders that a listing at the LSE will open up financing sources not just for the first stage of the expansion but also for potential further stages in later years. The CEO proposal refers to a stock exchange listing via the issuance of new shares through an Initial Public Offering (IPO). Existing as well as future shareholders have one vote per share.

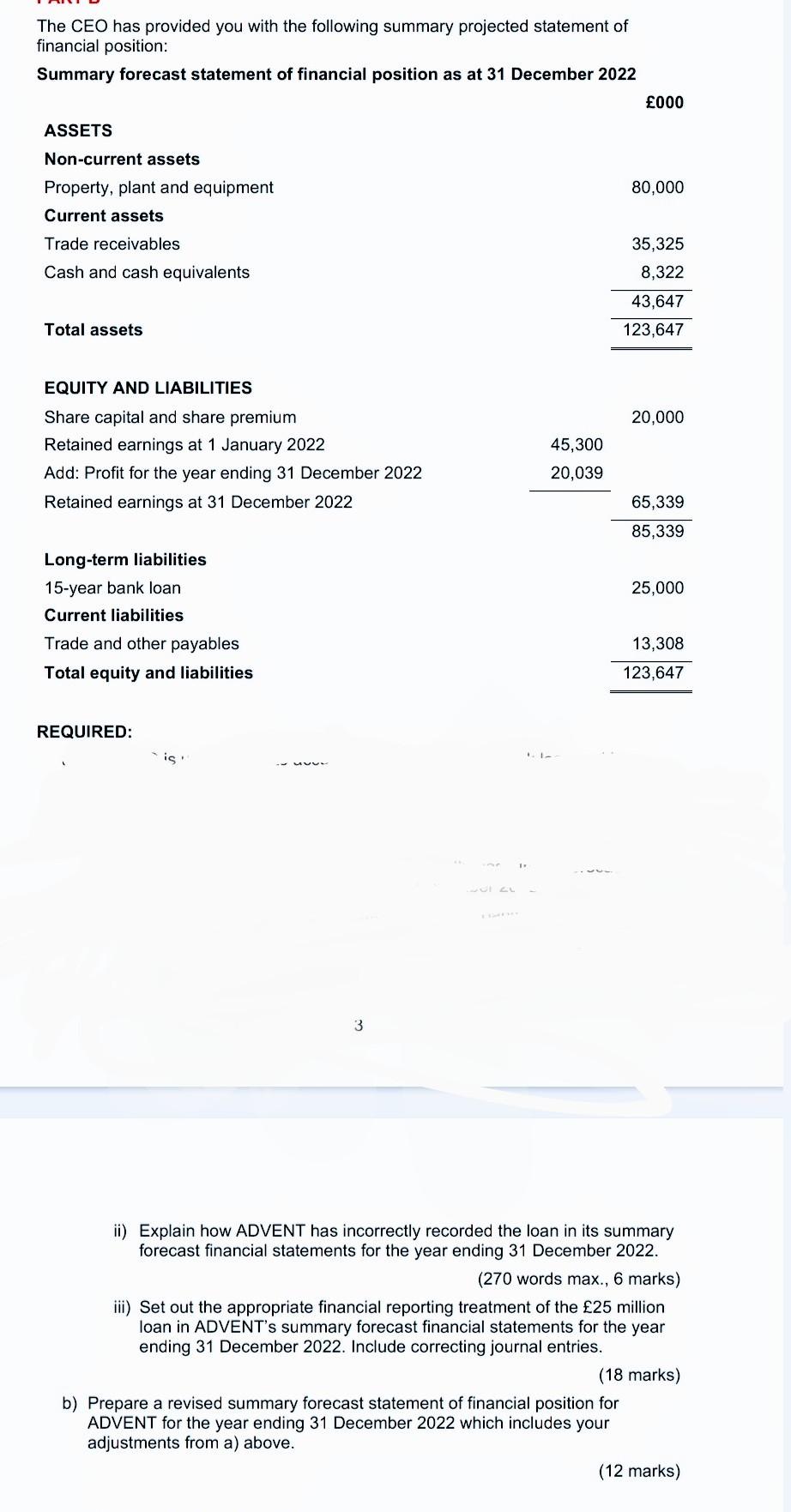

The CEO has provided you with the following summary projected statement of financial position: Summary forecast statement of financial position as at 31 December 2022 000 80,000 ASSETS Non-current assets Property, plant and equipment Current assets Trade receivables Cash and cash equivalents 35,325 8,322 43,647 Total assets 123,647 EQUITY AND LIABILITIES 20,000 Share capital and share premium Retained earnings at 1 January 2022 Add: Profit for the year ending 31 December 2022 Retained earnings at 31 December 2022 45,300 20,039 65,339 85,339 25,000 Long-term liabilities 15-year bank loan Current liabilities Trade and other payables Total equity and liabilities 13,308 123,647 REQUIRED: is 3 ii) Explain how ADVENT has incorrectly recorded the loan in its summary forecast financial statements for the year ending 31 December 2022. (270 words max., 6 marks) iii) Set out the appropriate financial reporting treatment of the 25 million loan in ADVENT's summary forecast financial statements for the year ending 31 December 2022. Include correcting journal entries. (18 marks) b) Prepare a revised summary forecast statement of financial position for ADVENT for the year ending 31 December 2022 which includes your adjustments from a) above. (12 marks) The CEO has provided you with the following summary projected statement of financial position: Summary forecast statement of financial position as at 31 December 2022 000 80,000 ASSETS Non-current assets Property, plant and equipment Current assets Trade receivables Cash and cash equivalents 35,325 8,322 43,647 Total assets 123,647 EQUITY AND LIABILITIES 20,000 Share capital and share premium Retained earnings at 1 January 2022 Add: Profit for the year ending 31 December 2022 Retained earnings at 31 December 2022 45,300 20,039 65,339 85,339 25,000 Long-term liabilities 15-year bank loan Current liabilities Trade and other payables Total equity and liabilities 13,308 123,647 REQUIRED: is 3 ii) Explain how ADVENT has incorrectly recorded the loan in its summary forecast financial statements for the year ending 31 December 2022. (270 words max., 6 marks) iii) Set out the appropriate financial reporting treatment of the 25 million loan in ADVENT's summary forecast financial statements for the year ending 31 December 2022. Include correcting journal entries. (18 marks) b) Prepare a revised summary forecast statement of financial position for ADVENT for the year ending 31 December 2022 which includes your adjustments from a) above. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts