Question: IFRS METHOD ASSESSMENT ACTIVITY: DEPRECIACTION BY COMPONENTS 20 points OBJECTIVES 1. Describe the critical role of international perspectives in the application of accounting. 2. Improve

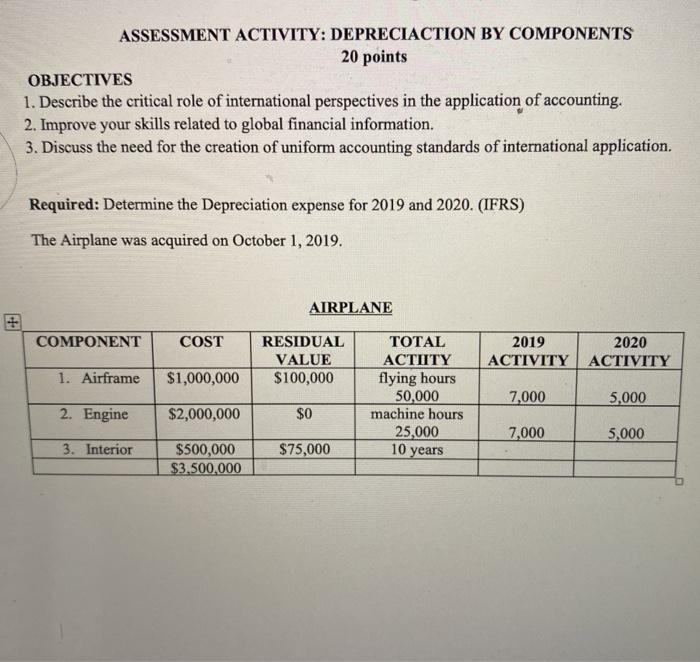

ASSESSMENT ACTIVITY: DEPRECIACTION BY COMPONENTS 20 points OBJECTIVES 1. Describe the critical role of international perspectives in the application of accounting. 2. Improve your skills related to global financial information. 3. Discuss the need for the creation of uniform accounting standards of international application. Required: Determine the Depreciation expense for 2019 and 2020. (IFRS) The Airplane was acquired on October 1, 2019. AIRPLANE COMPONENT COST RESIDUAL VALUE $100,000 2019 ACTIVITY 2020 ACTIVITY 1. Airframe $1,000,000 TOTAL ACTIITY flying hours 50,000 machine hours 25,000 7,000 5,000 2. Engine $2,000,000 $0 7,000 5,000 3. Interior $75,000 10 years $500,000 $3,500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts