Question: IFRS please the steps One employee will earn pensions over three years. The pension will be paid out after the third year as a lump

IFRS please the steps

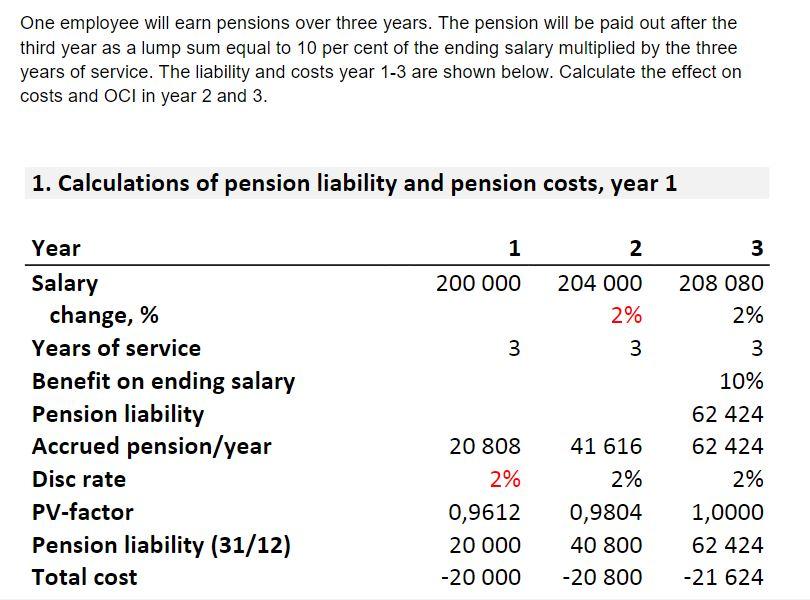

One employee will earn pensions over three years. The pension will be paid out after the third year as a lump sum equal to 10 per cent of the ending salary multiplied by the three years of service. The liability and costs year 1-3 are shown below. Calculate the effect on costs and OCI in year 2 and 3. 1. Calculations of pension liability and pension costs, year 1 3 1 200 000 2 204 000 2% 208 080 2% 3 3 Year Salary change, % Years of service Benefit on ending salary Pension liability Accrued pension/year Disc rate PV-factor Pension liability (31/12) Total cost 3 10% 62 424 62 424 2% 20 808 2% 0,9612 20 000 -20 000 41 616 2% 0,9804 40 800 -20 800 1,0000 62 424 -21 624

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts