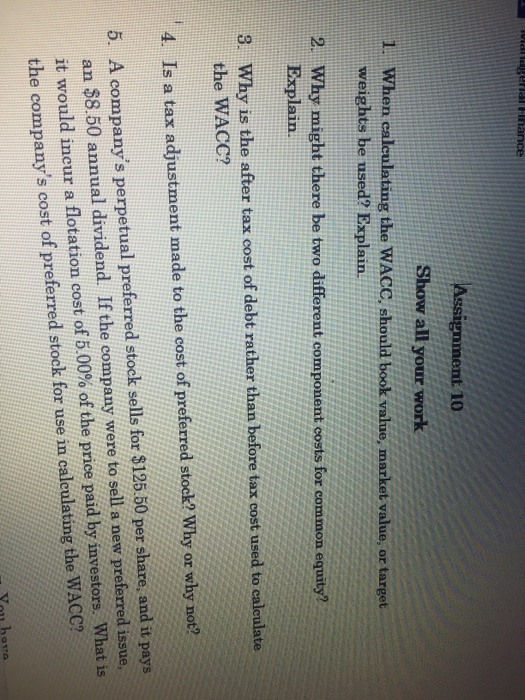

Question: ignment 10 Show all your work 1. When ealeulating the WACC, shoula book value, market value, or target weights be used? Explairn. 2. Why might

ignment 10 Show all your work 1. When ealeulating the WACC, shoula book value, market value, or target weights be used? Explairn. 2. Why might there be two different component costs for common equity? Explain. 8 Why is the after tax cost of debt rather than before tax cost used to calculate the WACC? 4. Is a tax adjustment made to the cost of preferred stock? Why or why not? A company's perpetual preferred stock sells for $125.50 per share, and it pays an $8.50 annual dividend. If the company were to sell a new preferred issue, it would incur a flotation cost of 5.00% of the price paid by investors. What is the company's cost of preferred stock for use in caleulating the WACc? 5. hotto

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts