Question: ignore (a) and (b), the question start from ( c ) a. A T-bill with 91-days to maturity and face value of GHS1,000 was bought

ignore (a) and (b), the question start from (c)

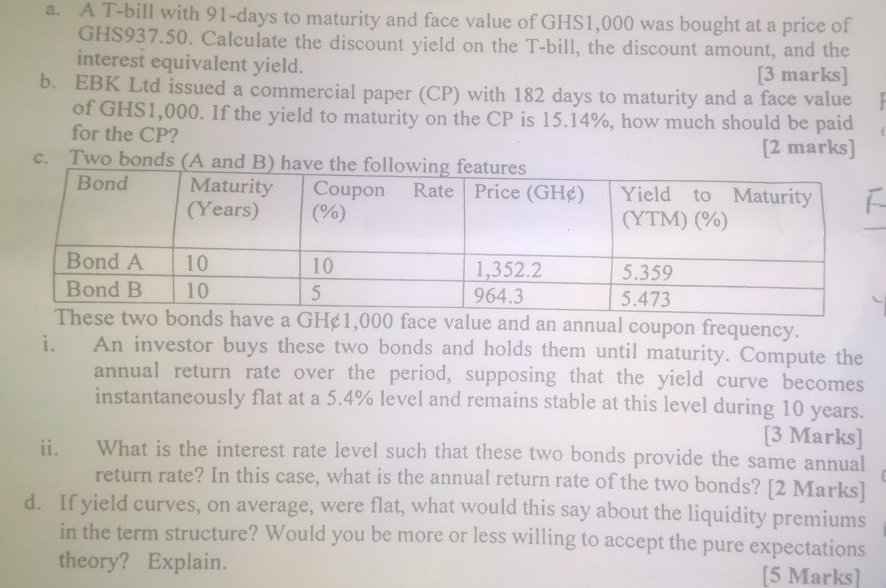

a. A T-bill with 91-days to maturity and face value of GHS1,000 was bought at a price of GHS937.50. Calculate the discount yield on the T-bill, the discount amount, and the interest equivalent yield. [3 marks] EBK Ltd issued a commercial paper (CP) with 182 days to maturity and a face value of GHS1,000. If the yield to maturity on the CP is 15.14%, how much should be paid for the CP? c. Two bonds (A and B) have the following features [2 marks] Bond Maturity Coupon Rate Price (GH) Yield to Maturity (Years) (%) (YTM) (%) 15 Bond A 10 10 1,352.2 5.359 Bond B 10 964.3 5.473 These two bonds have a GH1,000 face value and an annual coupon frequency. i. An investor buys these two bonds and holds them until maturity. Compute the annual return rate over the period, supposing that the yield curve becomes instantaneously flat at a 5.4% level and remains stable at this level during 10 years. [3 Marks] What is the interest rate level such that these two bonds provide the same annual return rate? In this case, what is the annual return rate of the two bonds? [2 Marks d. If yield curves, on average, were flat, what would this say about the liquidity premiums in the term structure? Would you be more or less willing to accept the pure expectations theory? Explain [5 Marks 11. a. A T-bill with 91-days to maturity and face value of GHS1,000 was bought at a price of GHS937.50. Calculate the discount yield on the T-bill, the discount amount, and the interest equivalent yield. [3 marks] EBK Ltd issued a commercial paper (CP) with 182 days to maturity and a face value of GHS1,000. If the yield to maturity on the CP is 15.14%, how much should be paid for the CP? c. Two bonds (A and B) have the following features [2 marks] Bond Maturity Coupon Rate Price (GH) Yield to Maturity (Years) (%) (YTM) (%) 15 Bond A 10 10 1,352.2 5.359 Bond B 10 964.3 5.473 These two bonds have a GH1,000 face value and an annual coupon frequency. i. An investor buys these two bonds and holds them until maturity. Compute the annual return rate over the period, supposing that the yield curve becomes instantaneously flat at a 5.4% level and remains stable at this level during 10 years. [3 Marks] What is the interest rate level such that these two bonds provide the same annual return rate? In this case, what is the annual return rate of the two bonds? [2 Marks d. If yield curves, on average, were flat, what would this say about the liquidity premiums in the term structure? Would you be more or less willing to accept the pure expectations theory? Explain [5 Marks 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts