Question: IGNORE ANY NUMBERS THAT MIGHT BE WRONG _ NEED HELP WITH THIS ASAP!FILL OUT YELLOW BOXES b Determine Optimal Transfer Price Given data Malaykey Data

IGNORE ANY NUMBERS THAT MIGHT BE WRONG NEED HELP WITH THIS ASAP!FILL OUT YELLOW BOXES

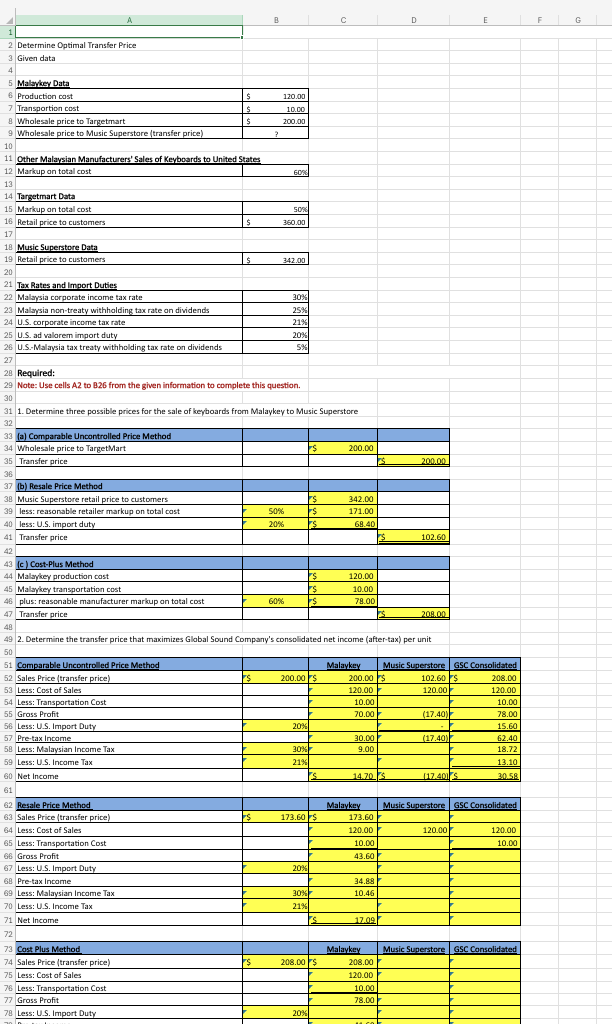

b Determine Optimal Transfer Price

Given data

Malaykey Data

Production cost$ Transportion cost$ Wholesale price to Targetmart$ Wholesale price to Music Superstore transfer price

Other Malaysian Manufacturers' Sales of Keyboards to United States

Markup on total cost

Targetmart Data

Markup on total costRetail price to customers$

Music Superstore Data

Retail price to customers$

Tax Rates and Import Duties

Malaysia corporate income tax rateMalaysia nontreaty withholding tax rate on dividendsUS corporate income tax rateUS ad valorem import dutyUSMalaysia tax treaty withholding tax rate on dividends

Required:

Determine three possible prices for the sale of keyboards from Malaykey to Music Superstore.

Determine the transfer price that maximizes Global Sound Company's consolidated net income aftertax per unit.

Determine the transfer price that maximizes net cash flow aftertax per unit to Global Sound Company of net income repatriated as a dividend no tax treaty.

Determine the transfer price that maximizes net cash flow aftertax per unit to Global Sound Company of net income repatriated as a dividend tax treaty withholding rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock