Question: ignore question 7 please answer question 4 the numbers submitted are said to be incorrect Question 7 0.5 pts A tax exempt municipality is considering

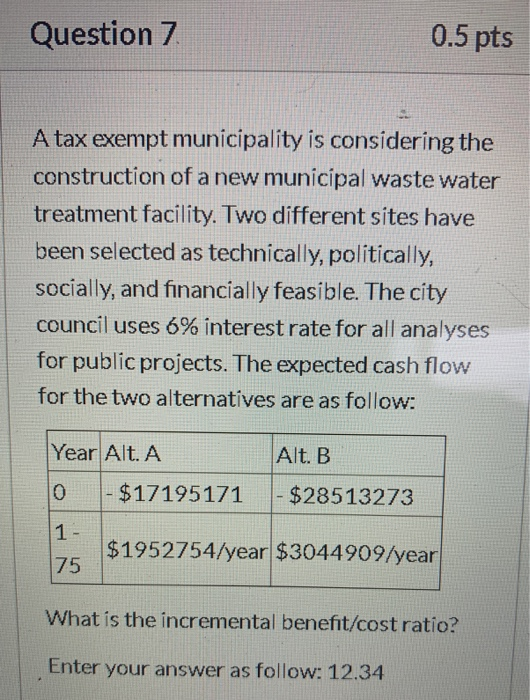

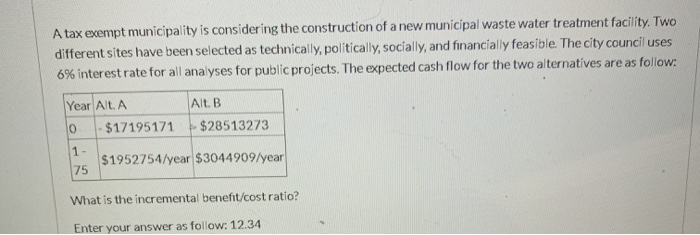

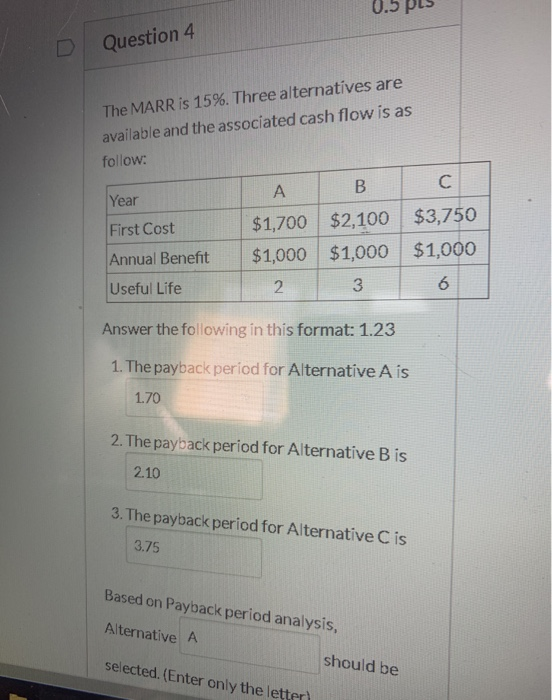

Question 7 0.5 pts A tax exempt municipality is considering the construction of a new municipal waste water treatment facility. Two different sites have been selected as technically, politically socially, and financially feasible. The city Council uses 6% interest rate for all analyses for public projects. The expected cash flow for the two alternatives are as follow Year Alt. A Alt. B $17195171 $28513273 1 - $1952754/year $3044909/year 75 What is the incremental benefit/cost ratio? Enter your answer as follow: 12.34 A tax exempt municipality is consider ing the construction of a new municipal waste water treatment facility. Two different sites have been selected as technically, politically, socially, and financially feasible. The city council uses 6% interest rate for all analyses for public projects. The expected cash flow for the two alternatives are as follow: Alt. B Year Alt. A $28513273 $17195171 1- $1952754/year $3044909/year 75 What is the incremental benefit/cost ratio? Enter your answer as follow: 12.34 Question 4 The MARR is 15%. Three alternatives are available and the associated cash flow is as follow: C A Year $3,750 $2,100 $1,700 First Cost $1,000 $1,000 $1,000 Annual Benefit 6 3 Useful Life 2 Answer the following in this format: 1.23 1. The payback pericd for Alternative A is 1.70 2. The payback period for Alternative B is 2.10 3. The payback pericd for Alternative C is 3.75 Based on Payback period analysis, Alternative A should be selected.(Enter only the letter)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts