Question: Ignore the answer there and show me an explained answer 8) (7 pts)XYZ can issue 4-year bonds in either US dollars or Euros. US dollar

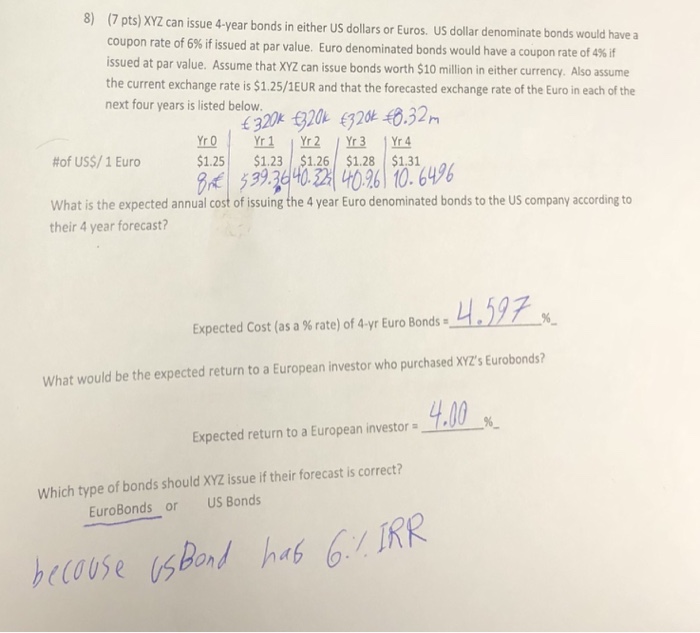

8) (7 pts)XYZ can issue 4-year bonds in either US dollars or Euros. US dollar denominate bonds would have a coupon rate of 6% if issued at par value. Euro denominated bonds would have a coupon rate of issued at par value. Assume that XYZ can issue bonds worth $10 million in either currency. Also assume the current exchange rate is $1.25/1EUR and that the forecasted exchange rate of the Euro in each of the next four years is listed below 4% if 320 320E320 0.32m $1.251 531.23-$12614026110364 #of US$/ 1 Euro What is the expected annual cost of issuing the 4 year Euro denominated bonds to the US company according to their 4 year forecast? 597 % - Expected Cost (as a % rate) of 4.yr Euro Bonds What would be the expected return to a European investor who purchased XYZ's Eurobonds? Expected return to a European investor . 4.00 % Which type of bonds should XYZ issue if their forecast is correct? EuroBonds or US Bonds beause sor heb G.IR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts