Question: Ignore the answer there and show me an explained answer 3) (7 pts) Assume that Jones Co. will make a payment of 1,000,000 pounds in

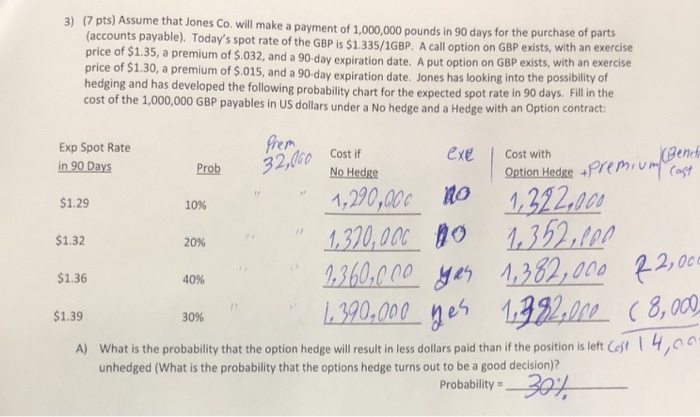

3) (7 pts) Assume that Jones Co. will make a payment of 1,000,000 pounds in 90 days for the purchase of parts (accounts payable). Today's spot rate of the GBP is $1.335/1GBP, A call option on GBP exists, with an exe price of $1.35, a premium of $.032, and a 90-day expiration date. A put op price of $1.30, a premium of $.015, and a 90- day expiration date. Jon hedging and has developed the following probability chart for the expected spot rate in 90 daysF cost of the 1,000,000 GBP payables in US dollars under a No hedge and a Hedge with an o tion on GBP exists, with an exercise es has looking into the possibility of Exp Spot Rate Go Costf exe Cost with ene 32,000 a in 90 Days $1.29 $1.32 Option Hedae r C90 ,00? to 142,000 20% 130,00 o 1,3520 Prob 10% 2360000 ye 1,382,02, $1.36 40% 0.000 ne $1.39 320.00 104in 30% A) What is the probability that the option hedge will result in less dollars paid than if the position is left Cest 4 unhedged (What is the probability that the options hedge turns out to be a good decision)? Probability 3) (7 pts) Assume that Jones Co. will make a payment of 1,000,000 pounds in 90 days for the purchase of parts (accounts payable). Today's spot rate of the GBP is $1.335/1GBP, A call option on GBP exists, with an exe price of $1.35, a premium of $.032, and a 90-day expiration date. A put op price of $1.30, a premium of $.015, and a 90- day expiration date. Jon hedging and has developed the following probability chart for the expected spot rate in 90 daysF cost of the 1,000,000 GBP payables in US dollars under a No hedge and a Hedge with an o tion on GBP exists, with an exercise es has looking into the possibility of Exp Spot Rate Go Costf exe Cost with ene 32,000 a in 90 Days $1.29 $1.32 Option Hedae r C90 ,00? to 142,000 20% 130,00 o 1,3520 Prob 10% 2360000 ye 1,382,02, $1.36 40% 0.000 ne $1.39 320.00 104in 30% A) What is the probability that the option hedge will result in less dollars paid than if the position is left Cest 4 unhedged (What is the probability that the options hedge turns out to be a good decision)? Probability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts