Question: ignore the first question. Please Solve the question below it. 2) Please build a spreadsheet similar to Table 6.1 to compute the maximum overdraft for

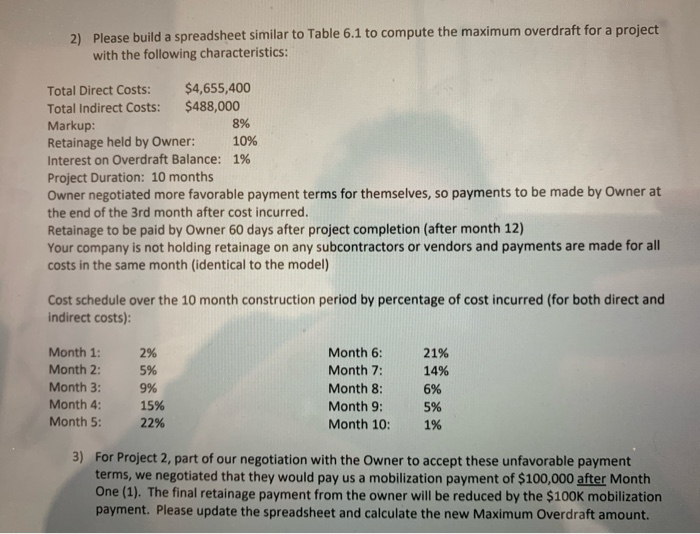

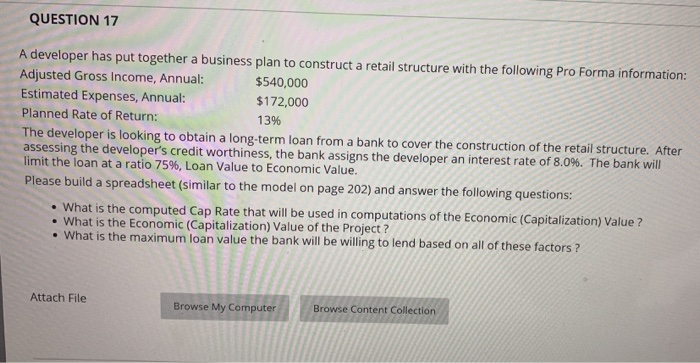

2) Please build a spreadsheet similar to Table 6.1 to compute the maximum overdraft for a project with the following characteristics: Total Direct Costs: $4,655,400 Total Indirect Costs: $488,000 Markup: 8% Retainage held by Owner: 10% Interest on Overdraft Balance: 1% Project Duration: 10 months Owner negotiated more favorable payment terms for themselves, so payments to be made by Owner at the end of the 3rd month after cost incurred. Retainage to be paid by Owner 60 days after project completion (after month 12) Your company is not holding retainage on any subcontractors or vendors and payments are made for all costs in the same month (identical to the model) Cost schedule over the 10 month construction period by percentage of cost incurred (for both direct and indirect costs): th 1 Month 1: Month 2: Month 3: Month 4: Month 5: 2% 5% 9% 15% 22% Month 6: Month 7: Month 8: Month 9: Month 10: 21% 14% 6% 5% 1% 3) For Project 2, part of our negotiation with the Owner to accept these unfavorable payment terms, we negotiated that they would pay us a mobilization payment of $100,000 after Month One (1). The final retainage payment from the owner will be reduced by the $100K mobilization payment. Please update the spreadsheet and calculate the new Maximum Overdraft amount. QUESTION 17 A developer has put together a business plan to construct a retail structure with the following Pro Forma information: Adjusted Gross Income, Annual: $540,000 Estimated Expenses, Annual: $172,000 Planned Rate of Return: 13% The developer is looking to obtain a long-term loan from a bank to cover the construction of the retail structure. After assessing the developer's credit worthiness, the bank assigns the developer ani limit the loan at a ratio 75%, Loan Value to Economic Value. Please build a spreadsheet (similar to the model on page 202) and answer the following questions: What is the computed Cap Rate that will be used in computations of the Economic (Capitalization) Value ? What is the Economic (Capitalization) Value of the Project? What is the maximum loan value the bank will be willing to lend based on all of these factors ? Attach File Browse My Computer Browse Content Collection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts