Question: Ignorning the potential for section 179 expense deduction table for the following situatuons. all assets were purchased in the current year Ignoring the potential for

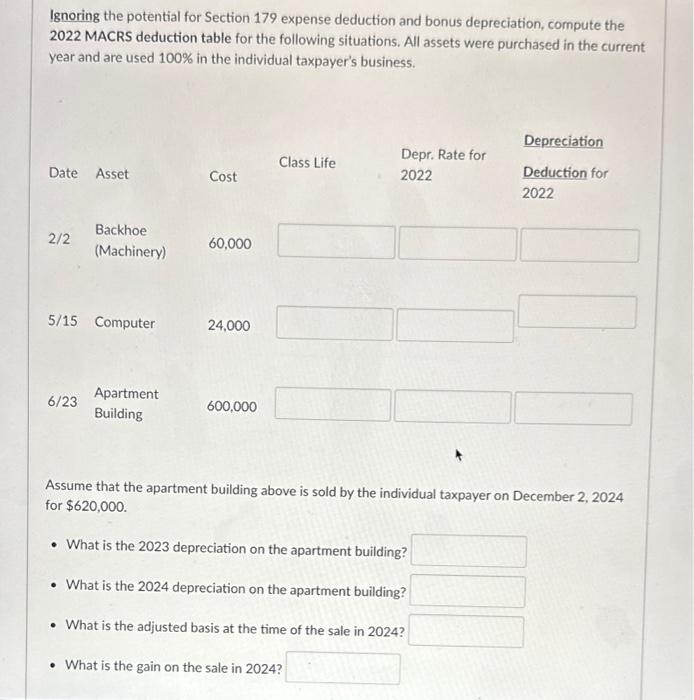

Ignoring the potential for Section 179 expense deduction and bonus depreciation, compute the 2022 MACRS deduction table for the following situations. All assets were purchased in the current year and are used 100% in the individual taxpayer's business. Assume that the apartment building above is sold by the individual taxpayer on December 2,2024 for $620,000. - What is the 2023 depreciation on the apartment building? - What is the 2024 depreciation on the apartment building? - What is the adjusted basis at the time of the sale in 2024? - What is the gain on the sale in 2024 ? Ignoring the potential for Section 179 expense deduction and bonus depreciation, compute the 2022 MACRS deduction table for the following situations. All assets were purchased in the current year and are used 100% in the individual taxpayer's business. Assume that the apartment building above is sold by the individual taxpayer on December 2,2024 for $620,000. - What is the 2023 depreciation on the apartment building? - What is the 2024 depreciation on the apartment building? - What is the adjusted basis at the time of the sale in 2024? - What is the gain on the sale in 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts