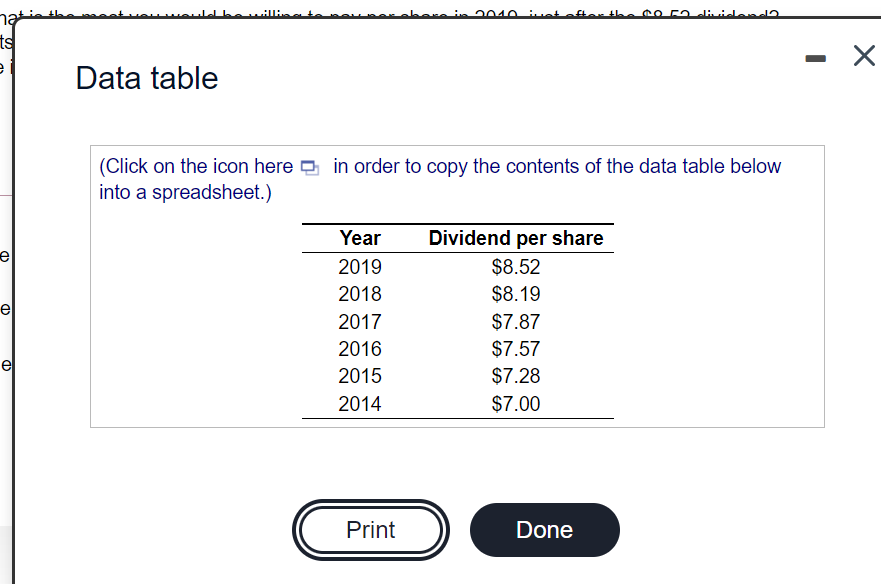

Question: IH nat ts e - Data table (Click on the icon here in order to copy the contents of the data table below into a

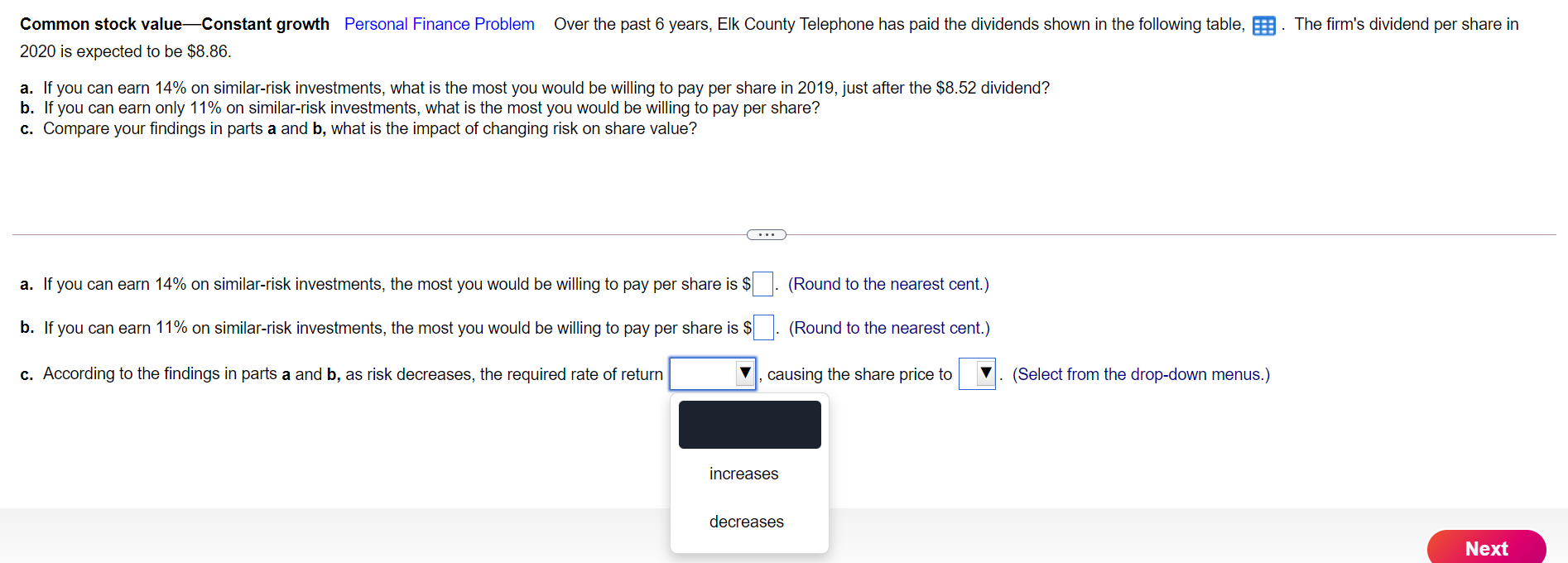

IH nat ts e - Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) e CD el Year 2019 2018 2017 2016 2015 2014 Dividend per share $8.52 $8.19 $7.87 $7.57 $7.28 $7.00 el Print Done Common stock value-Constant growth Personal Finance Problem Over the past 6 years, Elk County Telephone has paid the dividends shown in the following table, . The firm's dividend per share in 2020 is expected to be $8.86. a. If you can earn 14% on similar-risk investments, what is the most you would be willing to pay per share in 2019, just after the $8.52 dividend? b. If you can earn only 11% on similar-risk investments, what is the most you would be willing to pay per share? c. Compare your findings in parts a and b, what is the impact of changing risk on share value? a. If you can earn 14% on similar-risk investments, the most you would be willing to pay per share is $ (Round to the nearest cent.) b. If you can earn 11% on similar-risk investments, the most you would be willing to pay per share is $ (Round to the nearest cent.) c. According to the findings in parts a and b, as risk decreases, the required rate of return V, causing the share price to (Select from the drop-down menus.) increases decreases Next IH nat ts e - Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) e CD el Year 2019 2018 2017 2016 2015 2014 Dividend per share $8.52 $8.19 $7.87 $7.57 $7.28 $7.00 el Print Done Common stock value-Constant growth Personal Finance Problem Over the past 6 years, Elk County Telephone has paid the dividends shown in the following table, . The firm's dividend per share in 2020 is expected to be $8.86. a. If you can earn 14% on similar-risk investments, what is the most you would be willing to pay per share in 2019, just after the $8.52 dividend? b. If you can earn only 11% on similar-risk investments, what is the most you would be willing to pay per share? c. Compare your findings in parts a and b, what is the impact of changing risk on share value? a. If you can earn 14% on similar-risk investments, the most you would be willing to pay per share is $ (Round to the nearest cent.) b. If you can earn 11% on similar-risk investments, the most you would be willing to pay per share is $ (Round to the nearest cent.) c. According to the findings in parts a and b, as risk decreases, the required rate of return V, causing the share price to (Select from the drop-down menus.) increases decreases Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts