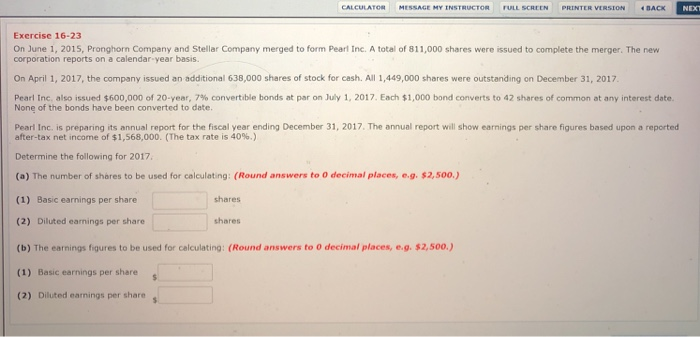

Question: IHE CALCULATOR MESSAGE MY INSTRUCTOR 'ULL SCRE tN PRINTER VERSION BACK Exercise 16-23 On June 1, 2015, Pronghorn Company and Stellar Company merged to form

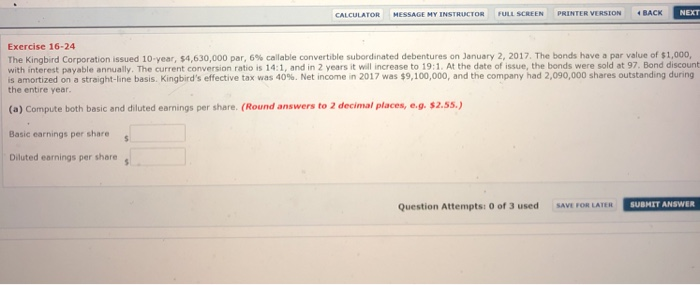

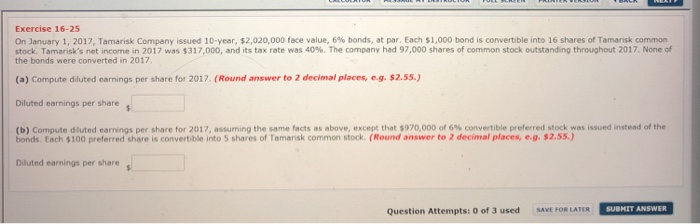

IHE CALCULATOR MESSAGE MY INSTRUCTOR 'ULL SCRE tN PRINTER VERSION BACK Exercise 16-23 On June 1, 2015, Pronghorn Company and Stellar Company merged to form Pearl Inc. A total of 811,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis On April 1, 2017, the company issued an additional 638,000 shares of stock for cash. All 1,449,000 shares were outstanding on December 31, 2017 Pearl Inc. also issued $600,000 of 20-year, 7% convertible bonds at par on July 1, 2017, Each $1,000 bond converts to 42 shares of common at any interest date. None of the bonds have been converted to date. Pearl Inc. is preparing its annual report for the fiscal year ending December 31, 2017. The annual report will show earnings per share figures based upon a reported after-tax net income of $1,568,000. (The tax rate is 40%.) Determine the following for 2017 (a) The number of shares to be used for calculating: (Round answers to O decimal places, e.g. $2,50o.) (1) Basic earnings per share (2) Diluted earnings per share (b) The earnings figures to be used for celculating: (Round answers to 0 decimal places, e.g. $2,500.) (1) Basic earnings per share (2) Diluted earnings per shares shares shares CALCULATOR MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK NEXT Exercise 16-24 The Kingbird Corporation issued 10-year, $4,630,000 par 6% calable convertible subo dinated debentures on january 2, 2012 The bonds have a par value of stoc with interest payable annually. The current conversion ratio is 14:1, and in 2 years it will increase to 19:1. At the date of issue, the bonds were sold at 97. Bond discount is amortized on a straight-l ne basis. Kingbird's effective tax was 40%. Net income in 2017 was $9,100,000 and the company had 2,090 000 shares outstanding during the entire year. (a) Compute both basic and diluted earnings per share. (Round answers to 2 decimal places,e.g.$2.55.) Basic earnings per share s Diluted earnings per share Question Attempts: 0 of 3 used SAVE FOR LATER SUBMET ANSWER Exercise 16-25 On January 1, 2017, Tamarisk Company issued 10-year, $2,020,000 face value, 6% bonds, at par. Each S1,000 bond is convert ble into 16 shares of Tomana commen stock. Tam risk's net income in 2017 was $317,000 and its tax rate was 40%. The company had 97,000 shares of common stock outstanare throughout O, en the bonds were converted in 2017 (a) Compute diluted earnings per share for 2017, (Round answer to 2 decimal places, e-g. $2.55.) Diluted earnings per share (b Computedl ted earnings per share for 201 7, assuming the same facts as above, except that $97 ,000 of 6% convertible preferred stock as issued instead of the bonds. Each $100 preferred share is convertible into 5 shares of Tamarisk common stock. (Round answer to 2 decimal places, e.g. $2.55.) Diluted earnings per share Question Attempts: 0 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts