Question: II do not understand how to calculate E and D, what is change in interest rate? 11. Use the following balance sheet information to answer

II do not understand how to calculate E and D, what is change in interest rate?

II do not understand how to calculate E and D, what is change in interest rate?

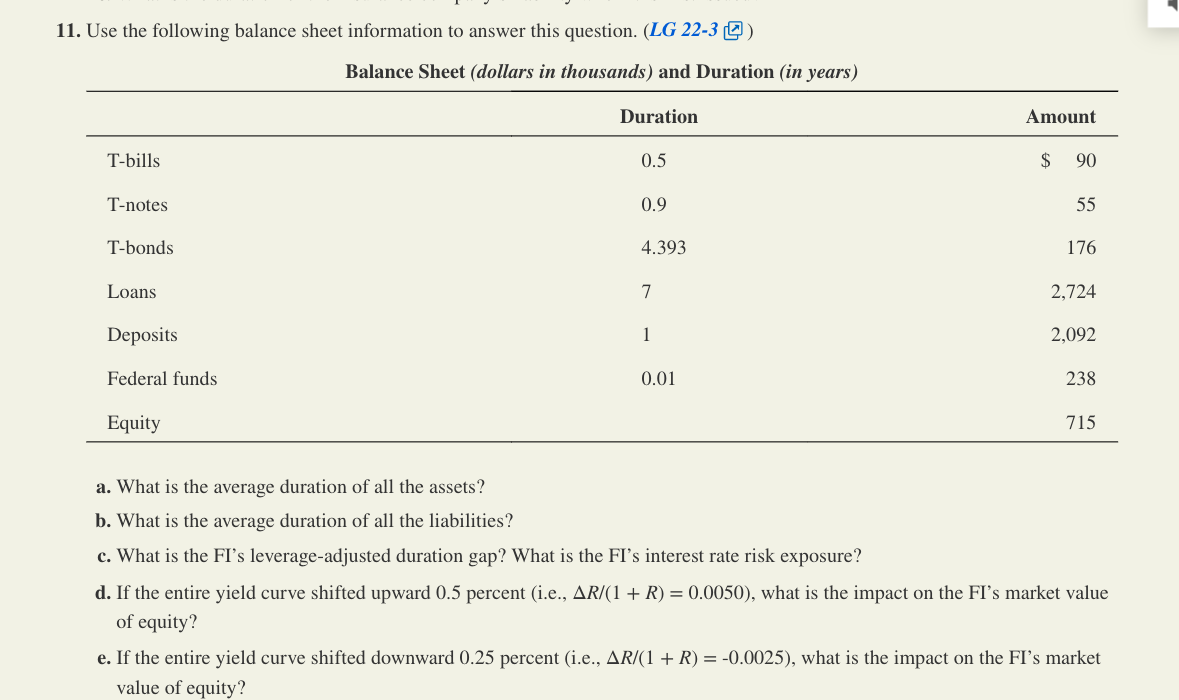

11. Use the following balance sheet information to answer this question. (LG 22-30) Balance Sheet (dollars in thousands) and Duration (in years) Duration Amount T-bills 0.5 $ 90 T-notes 0.9 55 T-bonds 4.393 176 Loans 7 2,724 Deposits 1 2,092 Federal funds 0.01 238 Equity 715 a. What is the average duration of all the assets? b. What is the average duration of all the liabilities? c. What is the FI's leverage-adjusted duration gap? What is the FI's interest rate risk exposure? d. If the entire yield curve shifted upward 0.5 percent (i.e., AR/(1 + R) = 0.0050), what is the impact on the FI's market value of equity? e. If the entire yield curve shifted downward 0.25 percent (i.e., AR/(1 + R) = -0.0025), what is the impact on the FI's market value of equity? 11. Use the following balance sheet information to answer this question. (LG 22-30) Balance Sheet (dollars in thousands) and Duration (in years) Duration Amount T-bills 0.5 $ 90 T-notes 0.9 55 T-bonds 4.393 176 Loans 7 2,724 Deposits 1 2,092 Federal funds 0.01 238 Equity 715 a. What is the average duration of all the assets? b. What is the average duration of all the liabilities? c. What is the FI's leverage-adjusted duration gap? What is the FI's interest rate risk exposure? d. If the entire yield curve shifted upward 0.5 percent (i.e., AR/(1 + R) = 0.0050), what is the impact on the FI's market value of equity? e. If the entire yield curve shifted downward 0.25 percent (i.e., AR/(1 + R) = -0.0025), what is the impact on the FI's market value of equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts