Question: II Explain in Detail and support with appropriate examplet wherever possible 1. In a highly integrated financial markets the multinational corporations efforts are to source

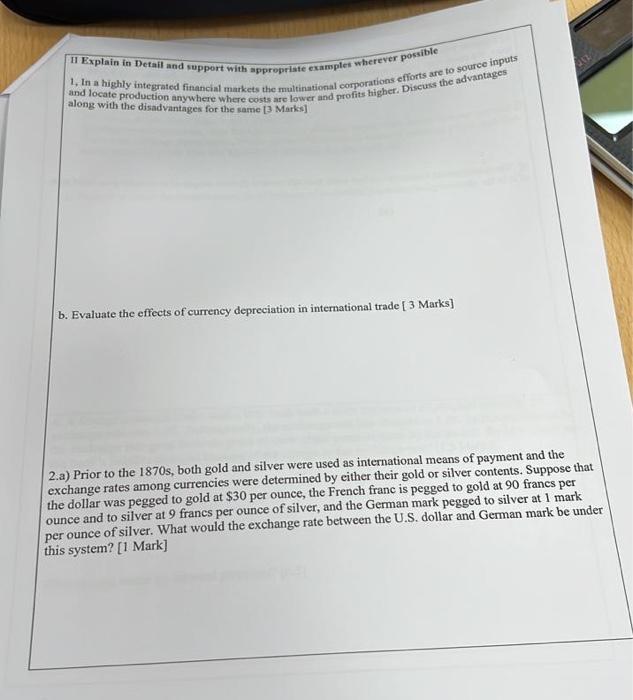

II Explain in Detail and support with appropriate examplet wherever possible 1. In a highly integrated financial markets the multinational corporations efforts are to source inputs 1. in a highly integrated financial markets the multinational corporations efforts are to source ingets and locate production anywhere where costs are lower and profits higher. Discuss the advantage along with the disadvantages for the same [3 Marks] b. Evaluate the effects of currency depreciation in international trade [ 3 Marks] 2.a) Prior to the 1870s, both gold and silver were used as international means of payment and the exchange rates among currencies were determined by either their gold or silver contents. Suppose that the dollar was pegged to gold at $30 per ounce, the French franc is pegged to gold at 90 francs per ounce and to silver at 9 francs per ounce of silver, and the Geman mark pegged to silver at 1 mark per ounce of silver. What would the exchange rate between the U.S. dollar and German mark be under this system? [1 Mark]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts