Question: II. Identify and justify which stock would be more appropriate for an investor who wants to a. add this stock to a well-diversified equity portfolio:

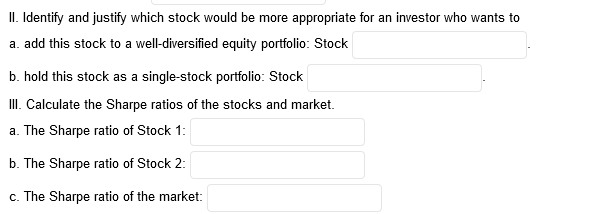

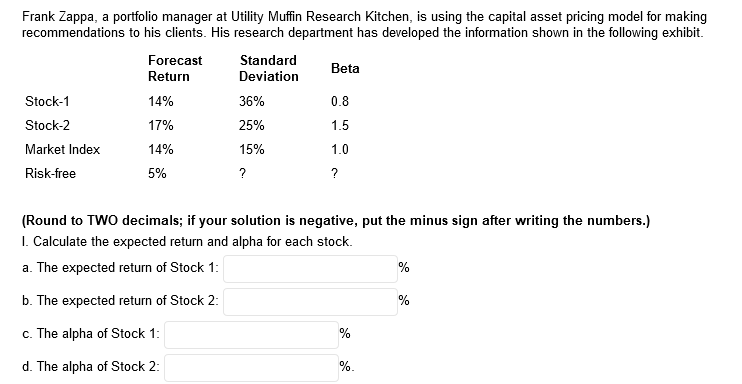

II. Identify and justify which stock would be more appropriate for an investor who wants to a. add this stock to a well-diversified equity portfolio: Stock b. hold this stock as a single-stock portfolio: Stock III. Calculate the Sharpe ratios of the stocks and market. a. The Sharpe ratio of Stock 1: b. The Sharpe ratio of Stock 2: c. The Sharpe ratio of the market: Frank Zappa, a portfolio manager at Utility Muffin Research Kitchen, is using the capital asset pricing model for making recommendations to his clients. His research department has developed the information shown in the following exhibit. Forecast Standard Return Beta Deviation Stock-1 14% 36% Stock-2 17% 25% 1.5 Market Index 14% 15% 1.0 Risk-free ? ? 0.8 5% (Round to TWO decimals; if your solution is negative, put the minus sign after writing the numbers.) 1. Calculate the expected return and alpha for each stock. a. The expected return of Stock 1: % b. The expected return of Stock 2: % c. The alpha of Stock 1: % d. The alpha of Stock 2: %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts