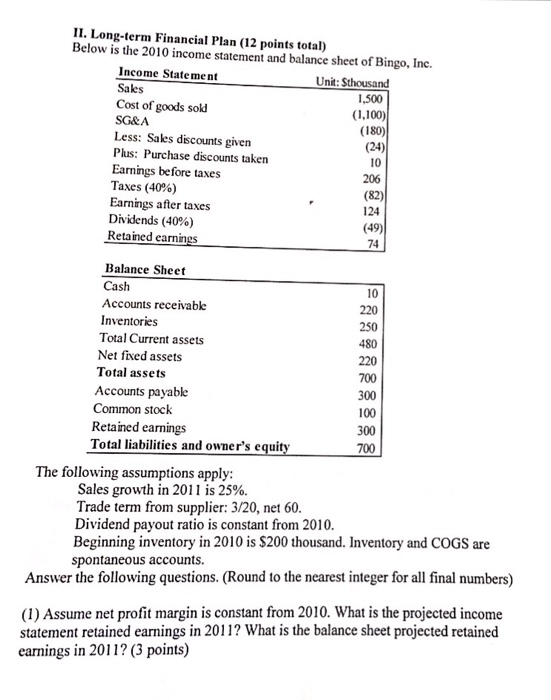

Question: II. Long-term Financial Plan (12 points total Below is the 2010 income statement and balance sheet ofBingo, Inc. Income Statement Unit: Sthousand Sales 1.500 Cost

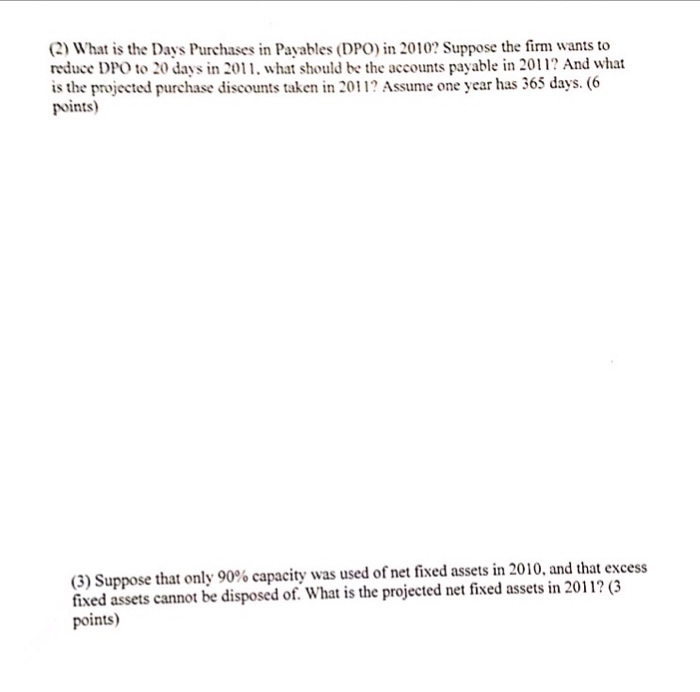

II. Long-term Financial Plan (12 points total Below is the 2010 income statement and balance sheet ofBingo, Inc. Income Statement Unit: Sthousand Sales 1.500 Cost of goods sold (1,100) SG&A (180 Less: Sales discounts given (24) Plus: Purchase discounts taken 10 Earnings before taxes 206 Taxes (40%) (82) Earnings after taxes 124 Dividends (40%) (49) Retained earnings 74 Balance Sheet Cash Accounts receivable 220 Inventories 250 Total Current assets 480 Net fived assets Total assets 700 Accounts payable 300 Common stock 100 Retained earnings 300 Total liabilities and owner's equity The following assumptions apply: Sales growth in 2011 is 25%. Trade term from supplier: 3/20, net 60. Dividend payout ratio is constant from 2010. Beginning inventory in 2010 is S200 thousand. Inventory and COGS are spontaneous accounts. Answer the following questions. (Round to the nearest integer for all final numbers) (1) Assume net profit margin is constant from 2010. What is the projected income statement retained earnings in 2011? What is the balance sheet projected retained earnings in 2011? 3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts