Question: II. Mini-Case Study Read the scenario below and then answer the questions. Complete your response in a Word document, and upload your project to the

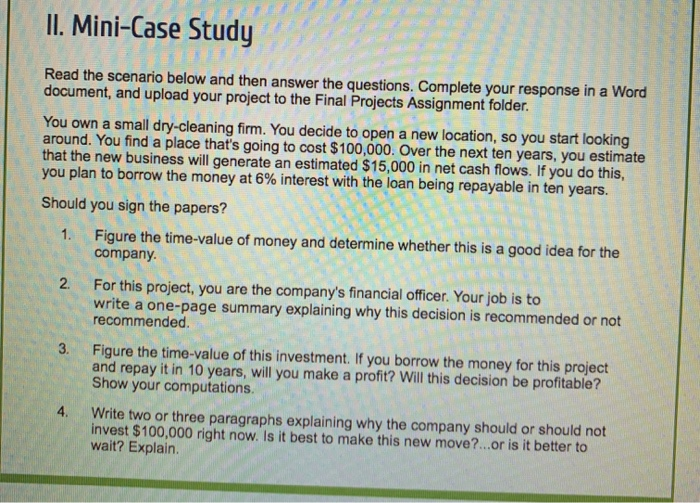

II. Mini-Case Study Read the scenario below and then answer the questions. Complete your response in a Word document, and upload your project to the Final Projects Assignment folder. You own a small dry-cleaning firm. You decide to open a new location, so you start looking around. You find a place that's going to cost $100,000. Over the next ten years, you estimate that the new business will generate an estimated $15,000 in net cash flows. If you do this, you plan to borrow the money at 6% interest with the loan being repayable in ten years. Should you sign the papers? 1. Figure the time-value of money and determine whether this is a good idea for the company. For this project, you are the company's financial officer. Your job is to write a one-page summary explaining why this decision is recommended or not recommended 3. Figure the time-value of this investment. If you borrow the money for this project and repay it in 10 years, will you make a profit? Will this decision be profitable? Show your computations. Write two or three paragraphs explaining why the company should or should not invest $100,000 right now. Is it best to make this new move?...or is it better to wait? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts