Question: II Multiple Choice (2.5 points each) 1. Off balance sheet financing may involve either A. An operating lease. B. A Bond C. Accounts Payable

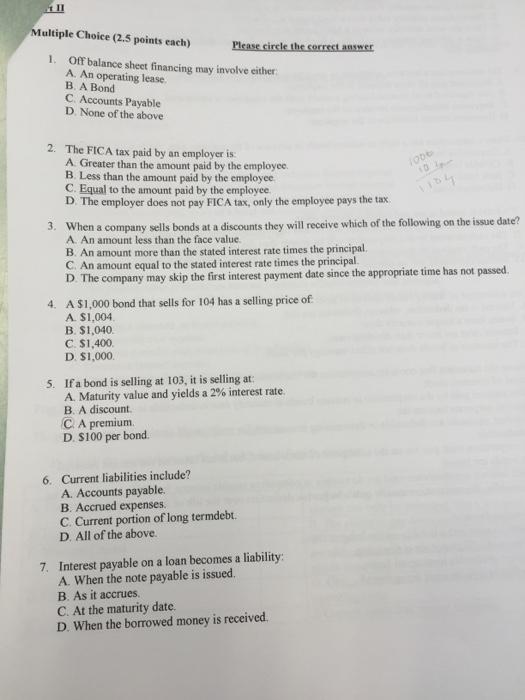

II Multiple Choice (2.5 points each) 1. Off balance sheet financing may involve either A. An operating lease. B. A Bond C. Accounts Payable D. None of the above 2. The FICA tax paid by an employer is: A Greater than the amount paid by the employee. B. Less than the amount paid by the employee. C. Equal to the amount paid by the employee. D. The employer does not pay FICA tax, only the employee pays the tax 3. When a company sells bonds at a discounts they will receive which of the following on the issue date? A. An amount less than the face value. B. An amount more than the stated interest rate times the principal. C. An amount equal to the stated interest rate times the principal. D. The company may skip the first interest payment date since the appropriate time has not passed. 4. A $1,000 bond that sells for 104 has a selling price of A. $1,004. B. $1,040. C. $1,400. D. $1,000. 5. If a bond is selling at 103, it is selling at: A. Maturity value and yields a 2% interest rate. B. A discount. CA premium. D. $100 per bond. 6. Current liabilities include? A. Accounts payable. B. Accrued expenses. C. Current portion of long termdebt. D. All of the above. 7. Interest payable on a loan becomes a liability: A. When the note payable is issued. B. As it accrues. C. At the maturity date. D. When the borrowed money is received. Please circle the correct answer 1006

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Ans1 a Operating leases are one of the most common forms of offbalancesheet fina... View full answer

Get step-by-step solutions from verified subject matter experts