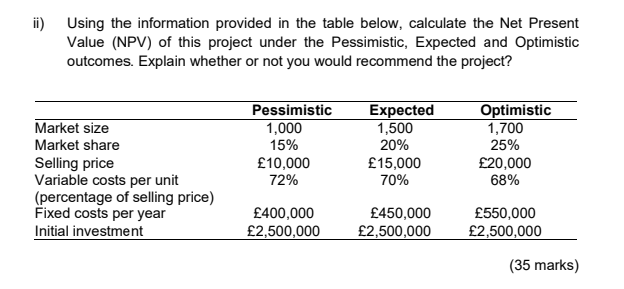

Question: ii) Using the information provided in the table below, calculate the Net Present Value (NPV) of this project under the Pessimistic, Expected and optimistic outcomes.

ii) Using the information provided in the table below, calculate the Net Present Value (NPV) of this project under the Pessimistic, Expected and optimistic outcomes. Explain whether or not you would recommend the project? Market size Market share Selling price Variable costs per unit (percentage of selling price) Fixed costs per year Initial investment Pessimistic 1,000 15% 10,000 72% Expected 1,500 20% 15,000 70% Optimistic 1,700 25% 20,000 68% 400,000 2,500,000 450,000 2,500,000 550,000 2,500,000 (35 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts