Question: II.) Variable Costing; A Tool for Decision Making (25 points) SOAPCO sells its product for $200 per unit. Variable manufacturing costs per unit are

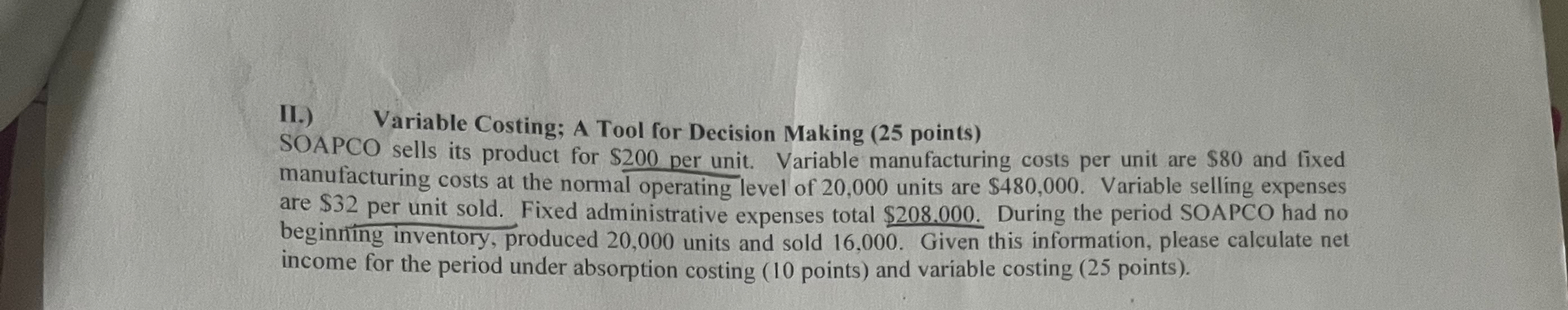

II.) Variable Costing; A Tool for Decision Making (25 points) SOAPCO sells its product for $200 per unit. Variable manufacturing costs per unit are $80 and fixed manufacturing costs at the normal operating level of 20,000 units are $480,000. Variable selling expenses are $32 per unit sold. Fixed administrative expenses total $208.000. During the period SOAPCO had no beginning inventory, produced 20,000 units and sold 16,000. Given this information, please calculate net income for the period under absorption costing (10 points) and variable costing (25 points).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts