Question: (ii) You are given: - The current US dollar/euro exchange rate is 1 per US dollar. - The dollar-denominated continuously compounding risk-free rate is 8%

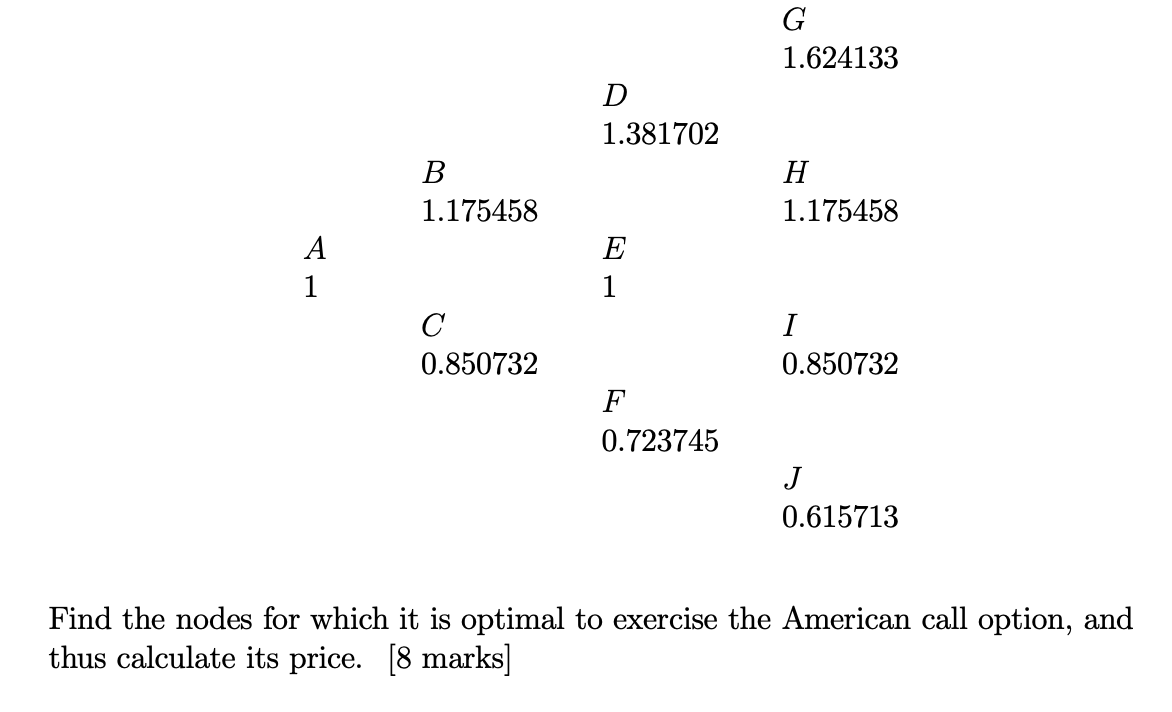

(ii) You are given: - The current US dollar/euro exchange rate is 1 per US dollar. - The dollar-denominated continuously compounding risk-free rate is 8% p.a. - The euro-denominated continuously compounding risk-free rate is 12% p.a. Consider a US\$-denominated American call option to buy 1 using 0.94 US dollars 1 year from now. You should use the following binomial tree that models the value of 1 in US dollars with three time steps of 4 months to value the call. Find the nodes for which it is optimal to exercise the American call option, and thus calculate its price. [8 marks]

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock