Question: IIA NOTE: There is no spreadsheet for this Client. Create a doc or sheet yourself and make sure you share it with me. Martin Co.

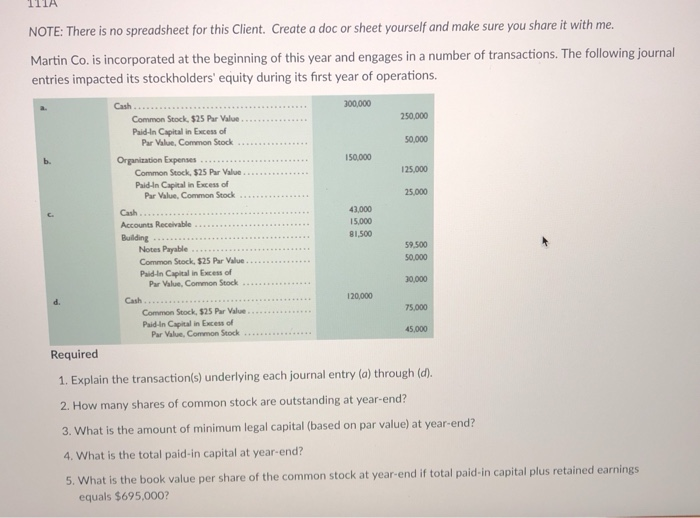

IIA NOTE: There is no spreadsheet for this Client. Create a doc or sheet yourself and make sure you share it with me. Martin Co. is incorporated at the beginning of this year and engages in a number of transactions. The following journal entries impacted its stockholders' equity during its first year of operations. 00,000 Cash. 250,000 Paid-In Capital in Excess of Par Value, Common Stock 0,000 150,000 b. Organization Expenses 125,000 Paid-In Capital in Exc.ess of 25,000 Par Value, Common Stock Cash Accounts Receivable 43,000 5,000 81,500 59,500 50,000 Notes Payable Paid-In Caplital in Excess of Par Value, Common Stock 120,000 Cash 75,000 Common Stock, $25 Par Value . Paid-n Capital in Excess of 45,000 Par Value, Common Stock Required 1. Explain the transaction/s) underlying each journal entry (a) through (d) 2. How many shares of common stock are outstanding at year-end? 3. What is the amount of minimum legal capital (based on par value) at year-end? 4. What is the total paid-in capital at year-end? 5. What is the book value per share e of the common stock at year-end if total paid-in capital plus retained earnings equals $695,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts