Question: III ) - Financial Ratios ( Points , 2 8 ) The following data is extracted from the financial statements prepared by XYZ

III Financial Ratios Points

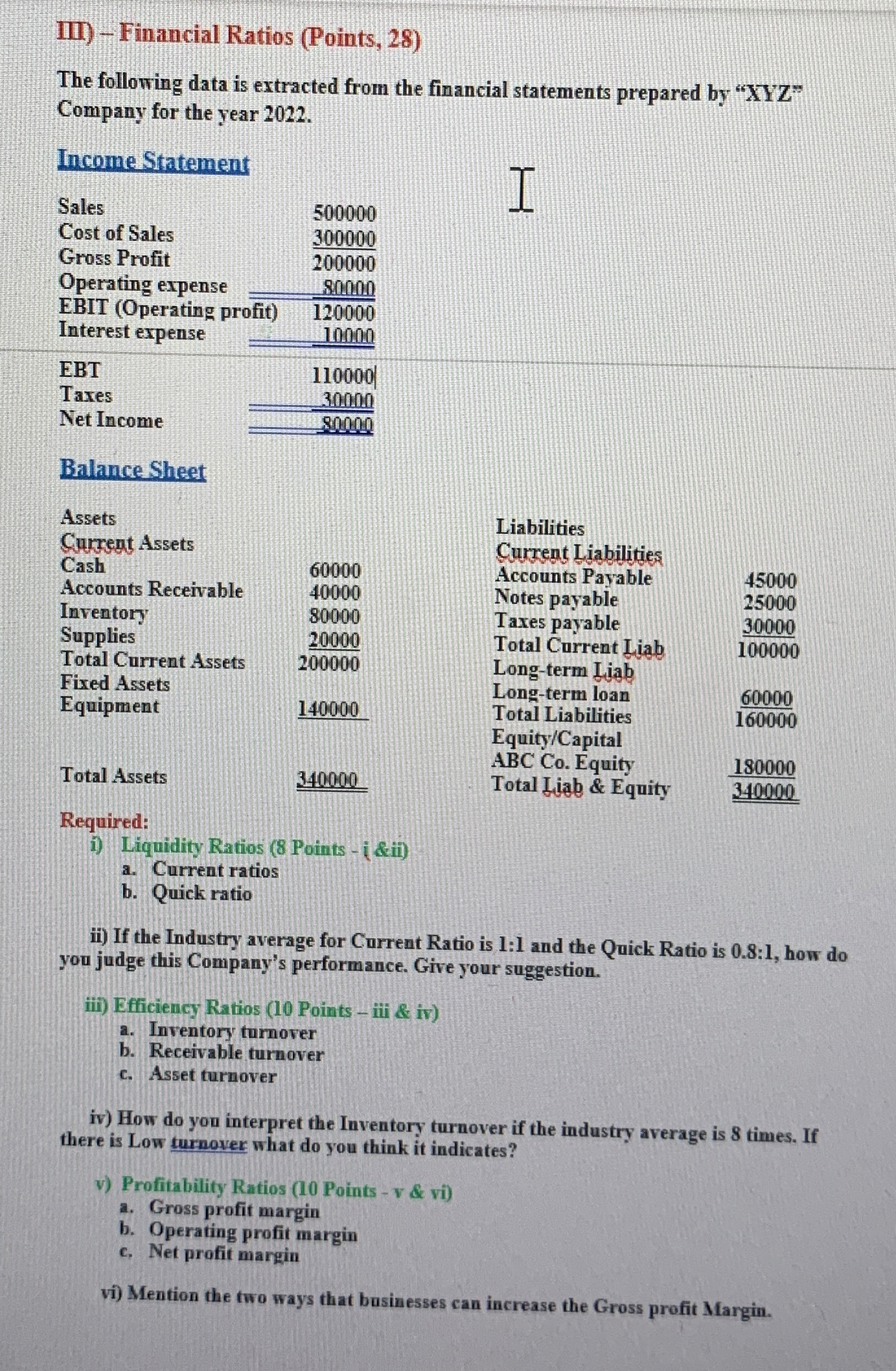

The following data is extracted from the financial statements prepared by XYZ Company for the year

Balance Sheet

tableAssetsLiabilities,Current Assets,,Current Liabilities,CashAccounts Payable,Accounts Receivable,Notes payable,InventoryTaxes payable,SuppliesTotal Current Liab,Total Current Assets,Longterm Liab,tableFixed AssetsEquipmentLongterm loan,EquipmentTotal Liabilities,tableABC CoTotal Assets,Total Liab & Equity,

Required:

i Liquidity Ratios Points i &ii

a Current ratios

b Quick ratio

ii If the Industry average for Current Ratio is : and the Quick Ratio is : how do you judge this Company's performance. Give your suggestion.

iii Efficiency Ratios Points iii & iv

a Inventory turnover

b Receivable turnover

c Asset turnover

iv How do you interpret the Inventory turnover if the industry average is times. If there is Low turnover what do you think it indicates?

v Profitability Ratios Points v & vi

a Gross profit margin

b Operating profit margin

c Net profit margin

vi Mention the two ways that businesses can increase the Gross profit Margin.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock