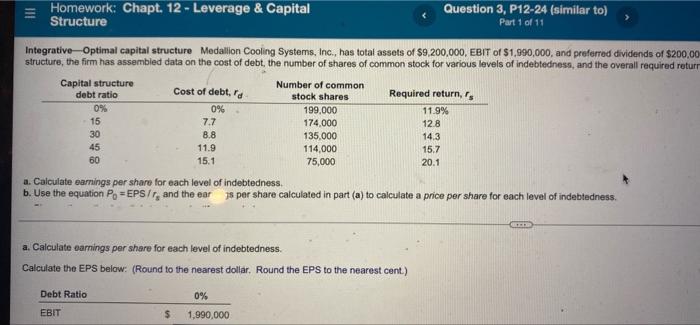

Question: III Homework: Chapt. 12 - Leverage & Capital Question 3, P12-24 (similar to) Structure Part 1 of 11 Integrative-Optimal capital structure Medallion Cooling Systems, Inc.,

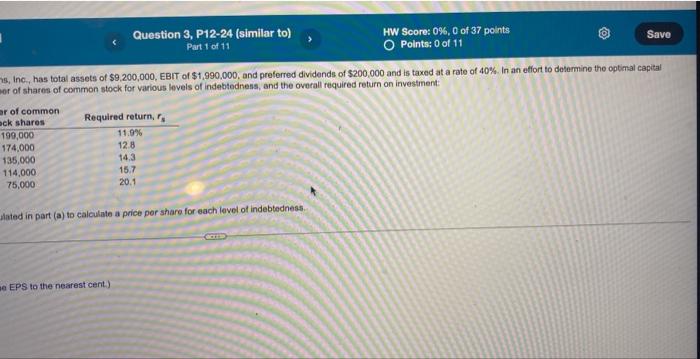

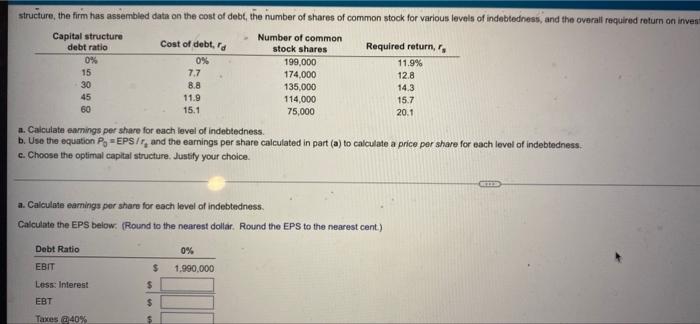

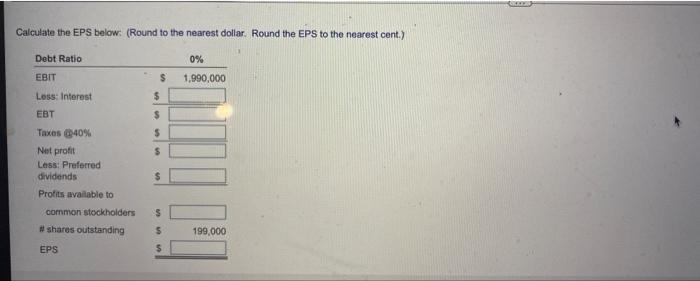

III Homework: Chapt. 12 - Leverage & Capital Question 3, P12-24 (similar to) Structure Part 1 of 11 Integrative-Optimal capital structure Medallion Cooling Systems, Inc., has total assets of $9,200,000, EBIT of S1,990,000, and preferred dividends of $200,00 structure, the firm has assembled data on the cost of debt, the number of shares of common stock for various levels of indebtedness, and the overall required returr Capital structure debt ratio Cost of debt.de Number of common stock shares Required return, 0% 0% 199,000 11.9% 15 7.7 174.000 128 30 8.8 135,000 143 45 11.9 114,000 15.7 60 75,000 20.1 15.1 a. Calculate earnings per share for each level of indebtedness b. Use the equation Po=EPS/r, and the ear is per share calculated in part (a) to calculate a price per share for each level of indebtedness a. Calculate earnings per share for each level of indebtedness Calculate the EPS below: (Round to the nearest dollar. Round the EPS to the nearest cent.) Debt Ratio 0% EBIT $ 1,990,000 . Question 3, P12-24 (similar to) HW Score: 0%, 0 of 37 points Points: 0 of 11 Save Part 1 of 11 s, Inc., has total assets of $9,200,000, EBIT of $1,990,000, and preferred dividends of $200,000 and is taxed at a rate of 40% In an effort to determine the optimal capital or of shares of common stock for various levels of indebtedness, and the overall required return on investment ar of common ock shares Required return, 199,000 174,000 128 135,000 14.3 114.000 15.7 75,000 20.1 11.9% ated in part (a) to calculate a price per share for each level of indebtedness e EPS to the nearest cent) structure, the firm has assembled data on the cost of debt, the number of shares of common stock for various levels of indebtedness, and the overall required return on inven Capital structure Number of common Cost of debt. debt ratio stock shares Required return, , 0% 0% 199,000 11.9% 15 7,7 174,000 12.8 30 8.8 135,000 14.3 45 11.9 114,000 60 15.1 75,000 20.1 a. Calculate earings per share for each level of indebtedness b. Use the equation P, EEPS IT, and the earnings per share calculated in part (a) to calculate a price per share for each level of indebtedness c. Choose the optimal capital structure. Justify your choice. 15.7 a. Calculate earnings per share for each level of indebtedness. Calculate the EPS below. (Round to the nearest dollar. Round the EPs to the nearest cant) Debt Ratio 0% EBIT $ 1.990.000 $ Less: Interest EBT $ Taxes 40% $ Calculate the EPS below: (Round to the nearest dollar. Round the EPS to the nearest cent.) Debt Ratio 0% $ 1.990,000 EBIT Less: Interest EBT $ $ $ $ $ Taxes 40% Net profit Lass: Preferred dividends Profits available to common stockholders #shares outstanding EPS $ $ 199,000 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts