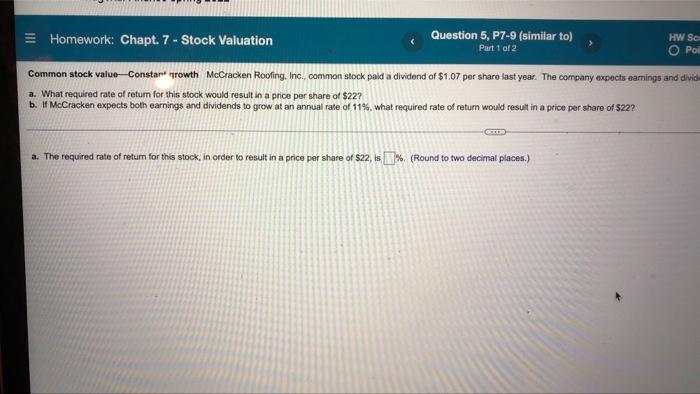

Question: III Homework: Chapt. 7 - Stock Valuation Question 5, P7-9 (similar to) Part 1 of 2 HW SC O Pol Common stock value-Constart growth McCracken

III Homework: Chapt. 7 - Stock Valuation Question 5, P7-9 (similar to) Part 1 of 2 HW SC O Pol Common stock value-Constart growth McCracken Roofing, Inc. common stock paid a dividend of $1.07 por share last year. The company expects earings and divide a. What required rate of return for this stock would result in a price per share of $22? b. If McCracken expects both earnings and dividends to grow at an annual rate of 11%, what required rate of return would result in a price per share of $22? a. The required rate of retum for this stock, in order to result in a price per share of $22, is % (Round to two decimal places.) Save Question 5, P7-9 (similar to) HW Score: 0%, 0 of 17 points Part 1 of 2 Points: 0 of 2 ammon stock paid a dividend of $1.07 per share last year. The company expects eamings and dividends to grow at a rate of 5% per year for the foreseeable future. al rate of 11%, what required rate of return would result in a price per share of $22? mare of $227 ar share of $22, is % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts