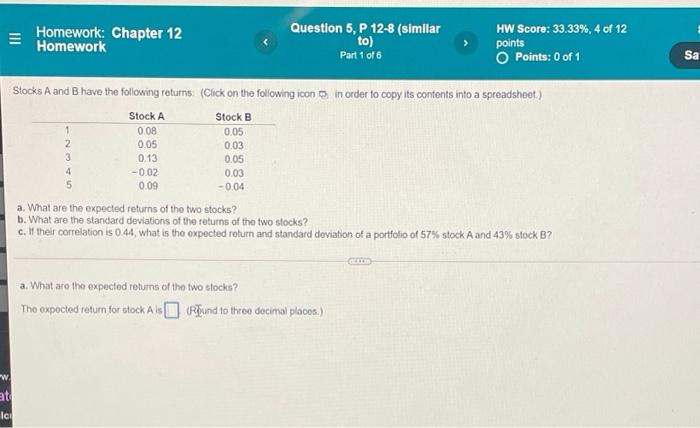

Question: III Homework: Chapter 12 Homework Question 5, P 12-8 (simllar to) Part 1 of 6 HW Score: 33.33%, 4 of 12 points Points: 0 of

III Homework: Chapter 12 Homework Question 5, P 12-8 (simllar to) Part 1 of 6 HW Score: 33.33%, 4 of 12 points Points: 0 of 1 Sa Stocks A and B have the following returns: (Click on the following icon in order to copy its contents into a spreadshoot) Stock A Stock B 0.08 0.05 0.05 0.03 0.05 -0.02 0.03 5 0.09 -0.04 a. What are the expected returns of the two stocks? b. What are the standard deviations of the returns of the two slocks? c. I their correlation is 0.44, what is the expected return and standard deviation of a portfolio of 57% stock A and 43% slock B? 1 2 3 4 0.13 a. What are the expected returns of the two stocko? Tho expocted return for stock A Round to three decimal placos.) w at Ic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts