Question: III Homework: Chapter 15 Homework Question 10, Problem 15- 13 Part 1 of 3 HW Score: 30%, 3 of 10 points O Points: 0 of

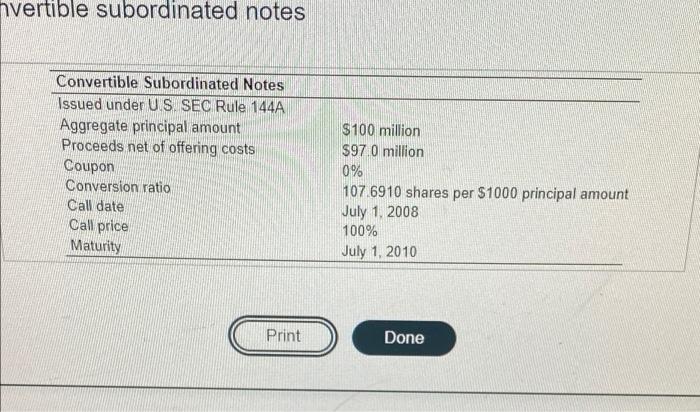

III Homework: Chapter 15 Homework Question 10, Problem 15- 13 Part 1 of 3 HW Score: 30%, 3 of 10 points O Points: 0 of 1 Save You are the CFO of a company on July 1, 2008. The company's stock price is $942 and its convertible debt (shown in the accompanying table) is now callable What is the value of the shares the bondholders would receive per 51000 bond if they convert? 6. What is the value per $1000 bond they would receive under the call? c. you call the bonds will the bondholders convertinto shaces or accept the call price? m Click the icon to view the table of convertible det kord a The value the bandholders would receive if they convertis (Round to the nearest cont) stioni stion 4 stion nvertible subordinated notes Convertible Subordinated Notes Issued under U.S. SEC Rule 144A Aggregate principal amount Proceeds net of offering costs Coupon Conversion ratio Call date Call price Maturity $ 100 million $97.0 million 0% 107.6910 shares per $1000 principal amount July 1, 2008 100% July 1, 2010 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts