Question: III. Optimal Machine Life You have been asked to evaluate the purchase of a new machine costing 200. Technically, the machine lasts 4 years and

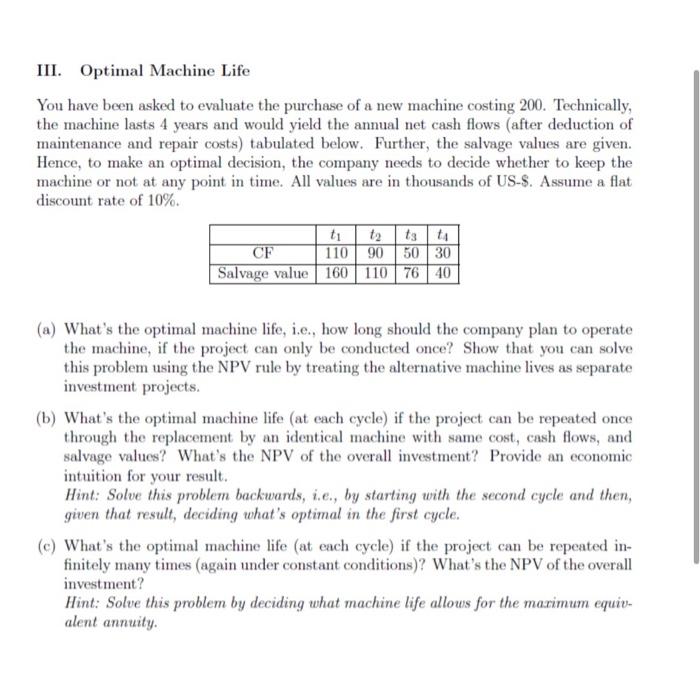

III. Optimal Machine Life You have been asked to evaluate the purchase of a new machine costing 200. Technically, the machine lasts 4 years and would yield the annual net cash flows (after deduction of maintenance and repair costs) tabulated below. Further, the salvage values are given. Hence, to make an optimal decision, the company needs to decide whether to keep the machine or not at any point in time. All values are in thousands of US-S. Assume a flat discount rate of 10%. (a) What's the optimal machine life, i.e., how long should the company plan to operate the machine, if the project can only be conducted once? Show that you can solve this problem using the NPV rule by treating the alternative machine lives as separate investment projects. (b) What's the optimal machine life (at each cycle) if the project can be repeated once through the replacement by an identical machine with same cost, cash flows, and salvage values? What's the NPV of the overall investment? Provide an economic intuition for your result. Hint: Solve this problem backwards, i.e., by starting with the second cycle and then, given that result, deciding what's optimal in the first cycle. (c) What's the optimal machine life (at each cycle) if the project can be repeated infinitely many times (again under constant conditions)? What's the NPV of the overall investment? Hint: Solve this problem by deciding what machine life allows for the maximum equivalent annuity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts