Question: III. Short answers 1. An 8% bond would pay $80 per year in interest for every $1,000 of principal. However, if the bond is currently

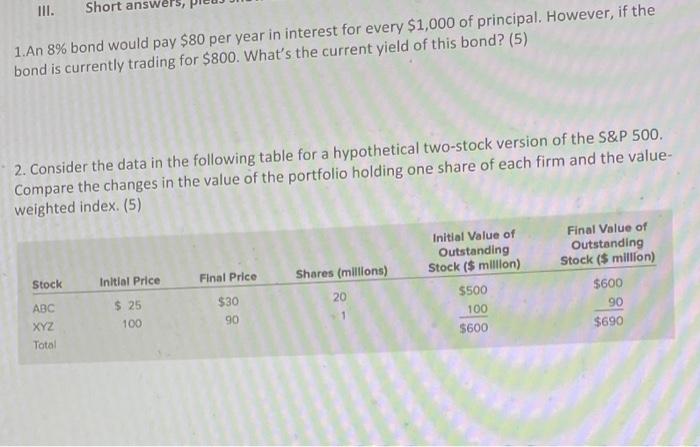

III. Short answers 1. An 8% bond would pay $80 per year in interest for every $1,000 of principal. However, if the bond is currently trading for $800. What's the current yield of this bond? (5) 2. Consider the data in the following table for a hypothetical two-stock version of the S&P 500. Compare the changes in the value of the portfolio holding one share of each firm and the value weighted index. (5) Shares (millions) Final Price Final Value of Outstanding Stock ($ million) $600 90 $690 Stock Initial Price Initial Value of Outstanding Stock ($ million) $500 100 $600 $ 25 100 $30 90 20 1 ABC XYZ Total

Step by Step Solution

There are 3 Steps involved in it

To solve these questions lets address them one by one 1 Current Yield of the Bond Current Yield Form... View full answer

Get step-by-step solutions from verified subject matter experts