Question: III. Small Questions (30 points and each 5 points) 1) and 2) The Argentine peso was fixed through a currency board at Ps1.35/5 throughout the

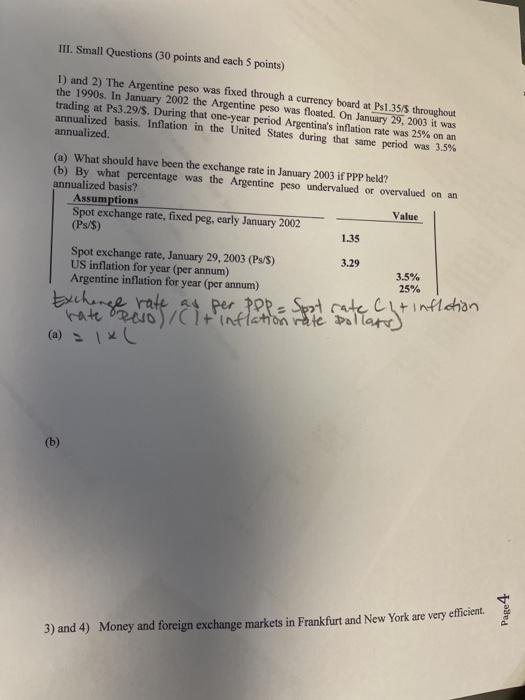

III. Small Questions (30 points and each 5 points) 1) and 2) The Argentine peso was fixed through a currency board at Ps1.35/5 throughout the 1990s. In January 2002 the Argentine peso was floated. On January 29, 2003 it was trading at Ps3.29/. During that one-year period Argentina's inflation rate was 25% on an annualized basis. Inflation in the United States during that same period was 3.5% annualized (a) What should have been the exchange rate in January 2003 if PPP held? (b) By what percentage was the Argentine peso undervalued or overvalued on an annualized basis? Assumptions Value Spot exchange rate, fixed peg, early January 2002 (Ps/5) 1.35 Spot exchange rate, January 29, 2003 (Ps/5) US inflation for year (per annum) Argentine inflation for year (per annum) 3.29 3.5% 25% rate secrets ay per pola Sost rate Cht inflation (+ ) (a) = x (b) Page 4 3) and 4) Money and foreign exchange markets in Frankfurt and New York are very efficient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts