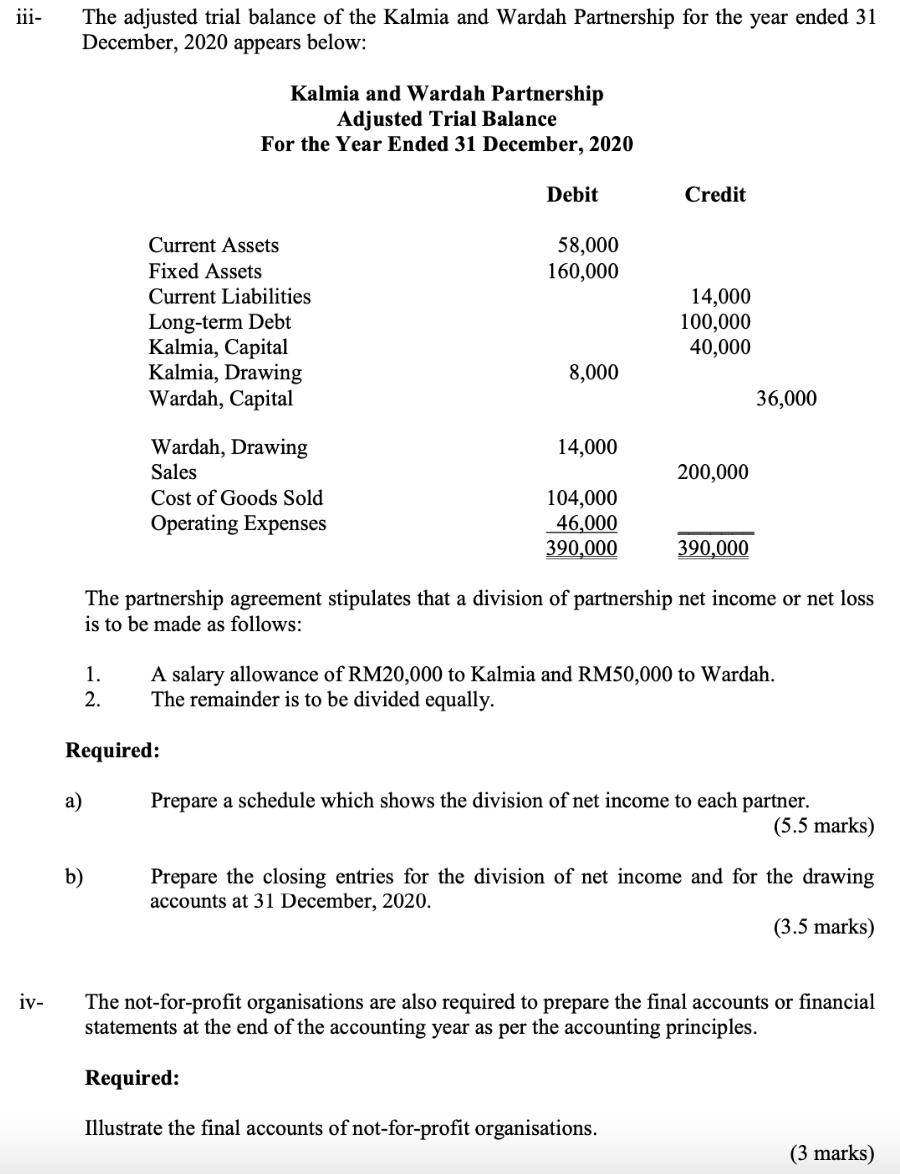

Question: iii- The adjusted trial balance of the Kalmia and Wardah Partnership for the year ended 31 December, 2020 appears below: Kalmia and Wardah Partnership

iii- The adjusted trial balance of the Kalmia and Wardah Partnership for the year ended 31 December, 2020 appears below: Kalmia and Wardah Partnership Adjusted Trial Balance For the Year Ended 31 December, 2020 Debit Credit Current Assets 58,000 Fixed Assets 160,000 Current Liabilities 14,000 Long-term Debt 100,000 Kalmia, Capital 40,000 Kalmia, Drawing 8,000 Wardah, Capital 14,000 Wardah, Drawing Sales 200,000 Cost of Goods Sold 104,000 Operating Expenses 46,000 390,000 390,000 The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows: 1. A salary allowance of RM20,000 to Kalmia and RM50,000 to Wardah. The remainder is to be divided equally. 2. Required: a) Prepare a schedule which shows the division of net income to each partner. (5.5 marks) b) Prepare the closing entries for the division of net income and for the drawing accounts at 31 December, 2020. (3.5 marks) iv- The not-for-profit organisations are also required to prepare the final accounts or financial statements at the end of the accounting year as per the accounting principles. Required: Illustrate the final accounts of not-for-profit organisations. (3 marks) 36,000

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

solution Profit Loss arcount and Appropriate Ale Amount ... View full answer

Get step-by-step solutions from verified subject matter experts