Question: iknow that's too much but please solve it and try to make it as clear as possible will thank you sir I have already solve

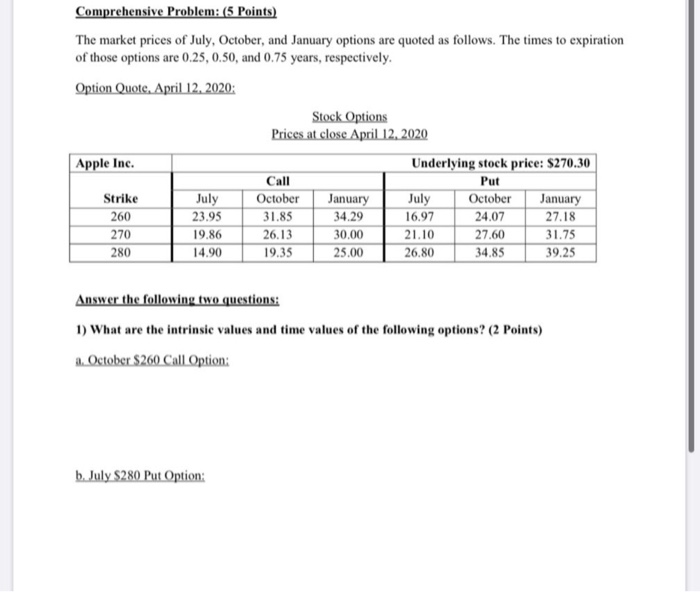

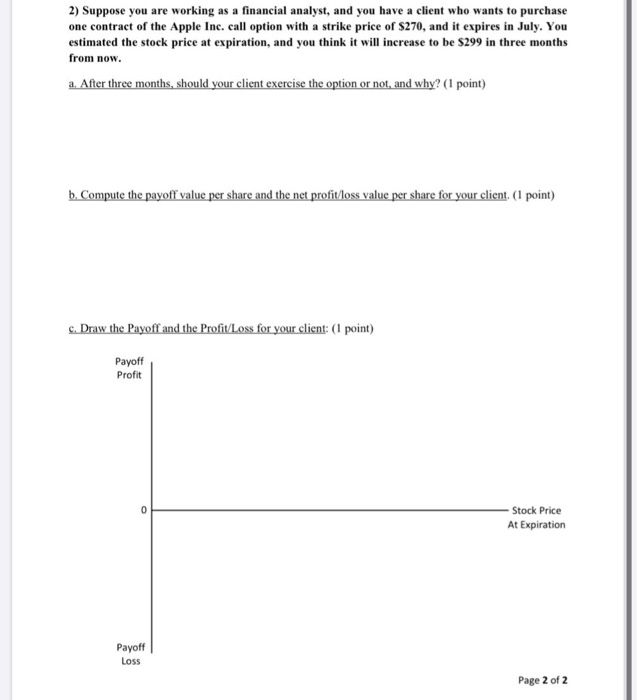

Comprehensive Problem: (5 Points) The market prices of July, October, and January options are quoted as follows. The times to expiration of those options are 0.25, 0.50, and 0.75 years, respectively. Option Quote, April 12. 2020: Stock Options Prices at close April 12. 2020 Apple Inc. Strike 260 270 280 July 23.95 19.86 14.90 Call October 31.85 26.13 19.35 January 34.29 30,00 25.00 Underlying stock price: $270.30 Put July October January 16.97 2 4,07 27.18 21.10 27.60 31.75 26.80 34.85 39.25 Answer the following two questions: 1) What are the intrinsic values and time values of the following options? (2 Points) 3. October $260 Call Option: b. July $280 Put Option: 2) Suppose you are working as a financial analyst, and you have a client who wants to purchase one contract of the Apple Inc. call option with a strike price of $270, and it expires in July. You estimated the stock price at expiration, and you think it will increase to be $299 in three months from now. a. After three months, should your client exercise the option or not, and why? (1 point) b. Compute the payoff value per share and the net profit/loss value per share for your client. (1 point) c. Draw the Payoff and the Profit/Loss for your client: (1 point) Payoff Profit Stock Price At Expiration Payoff Loss Page 2 of 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts