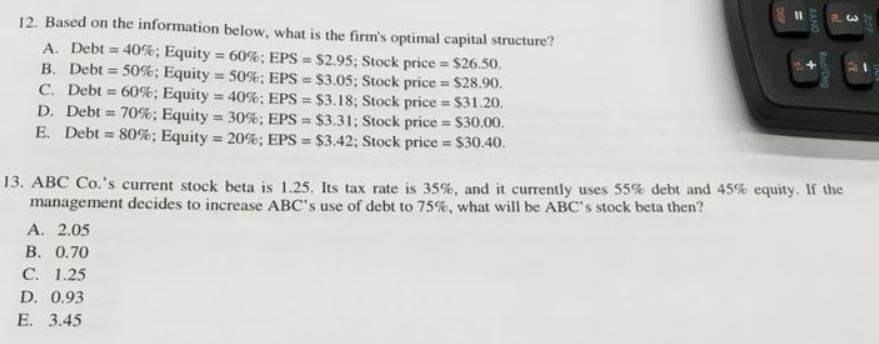

Question: Il 12. Based on the information below, what is the firm's optimal capital structure? A. Debt 40%; Equity 60%; EPs-$2.95; Stock price = S26.50. B.

Il 12. Based on the information below, what is the firm's optimal capital structure? A. Debt 40%; Equity 60%; EPs-$2.95; Stock price = S26.50. B. Debt-30%; Equity : 50%; EPS-S3.05: Stock prices S28.90. C. Debt-: 60%; Equity 40%; EPS-$3.18: Stock price-S3120. D. Debt = 70%; Equity-30%; EPs-$3.31; Stock price-$30.00. E. Debt-80%; Equity-20%; EPs-S3.42; Stock price-S3040. 13, ABC Co.'s current stock beta is 1.25. Its tax rate is 35%, and it currently uses 55% debt and 45% equity. If the management decides to increase ABC's use of debt to 75%, what will be ABC's stock beta then? A. 2.05 B. 0.70 C. 1.25 D. 0.93 E. 3.45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts