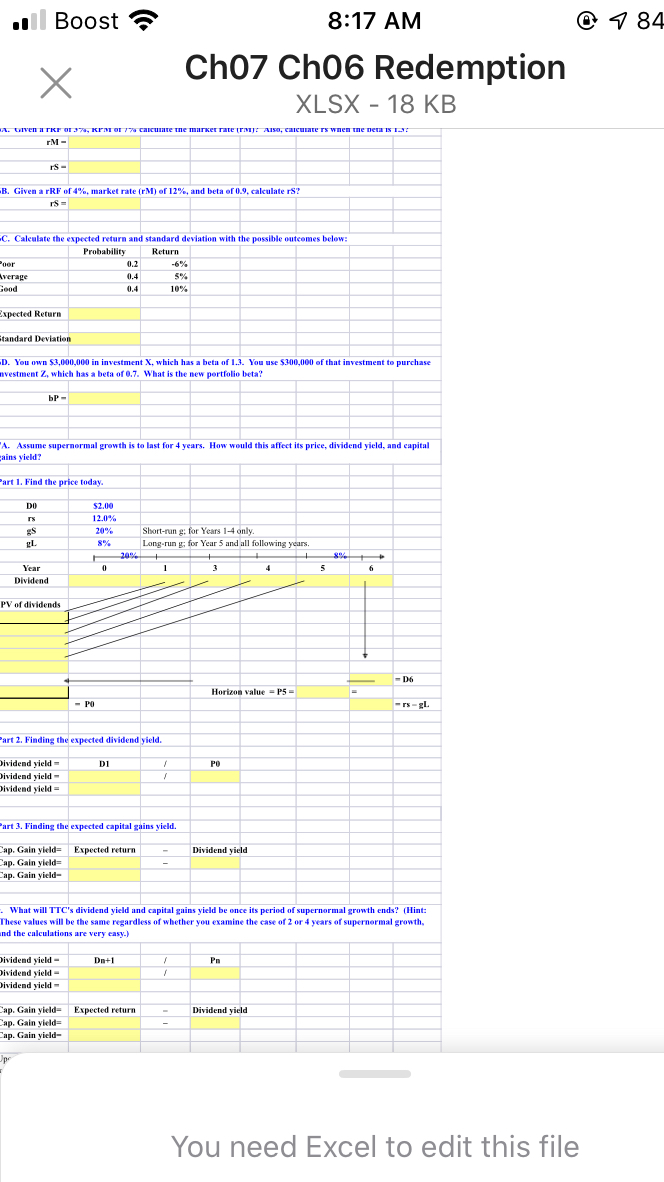

Question: Il Boost ? 8:17 AM @ 984 Choz Ch06 Redemption XLSX - 18 KB Sven TK 37. K OT 770 CALCUTITETTI M- IS -B. Given

Il Boost ? 8:17 AM @ 984 Choz Ch06 Redemption XLSX - 18 KB Sven TK 37. K OT 770 CALCUTITETTI M- IS -B. Given a rRF of 4%, market rate (M) of 12%, and beta of 0.9. calculaters? -C. Caleulate the expected return and standard deviation with the possible outcomes below: Probability Return 0. 4 5 % Good Expected Return Standard Deviation -D. You own $3,000,000 in investment X, which has a beta of 1.3. You use $300,000 of that investment to purchase nvestment Z. which has a beta of 0.7. What is the new portfolio Deta? "A. Assume supernormal growth is to last for 4 years. How would this affect its price, dividend yield, and capital cains yield? Part 1. Find the price today. DO 52.00 12.0% 20% Short-rang: for Years 1-4 only. Long-run g; for Year 5 and all following years. % Year Dividend PV of dividends Horizon value = P5 = Part 2. Finding the expected dividend yield. D1 PO Dividend yield- Dividend yield- Dividend yield = Part 3. Finding the expected capital gains yield. Expected return Dividend yield Cap. Gain yield Cap. Gain yield Cap. Gain yield- What will TTC's dividend yield and capital gains yield be once its period of supernormal growth ends? (Hint: These values will be the same regardless of whether you examine the case of 2 or 4 years of supernormal growth, and the calculations are very casy.) Dn+1 Pn Dividend yield- Dividend yield- Dividend yield- Expected return Dividend yield Cap. Gain yield Cap. Gain yield= Cap. Gain yield- You need Excel to edit this file Il Boost ? 8:17 AM @ 984 Choz Ch06 Redemption XLSX - 18 KB Sven TK 37. K OT 770 CALCUTITETTI M- IS -B. Given a rRF of 4%, market rate (M) of 12%, and beta of 0.9. calculaters? -C. Caleulate the expected return and standard deviation with the possible outcomes below: Probability Return 0. 4 5 % Good Expected Return Standard Deviation -D. You own $3,000,000 in investment X, which has a beta of 1.3. You use $300,000 of that investment to purchase nvestment Z. which has a beta of 0.7. What is the new portfolio Deta? "A. Assume supernormal growth is to last for 4 years. How would this affect its price, dividend yield, and capital cains yield? Part 1. Find the price today. DO 52.00 12.0% 20% Short-rang: for Years 1-4 only. Long-run g; for Year 5 and all following years. % Year Dividend PV of dividends Horizon value = P5 = Part 2. Finding the expected dividend yield. D1 PO Dividend yield- Dividend yield- Dividend yield = Part 3. Finding the expected capital gains yield. Expected return Dividend yield Cap. Gain yield Cap. Gain yield Cap. Gain yield- What will TTC's dividend yield and capital gains yield be once its period of supernormal growth ends? (Hint: These values will be the same regardless of whether you examine the case of 2 or 4 years of supernormal growth, and the calculations are very casy.) Dn+1 Pn Dividend yield- Dividend yield- Dividend yield- Expected return Dividend yield Cap. Gain yield Cap. Gain yield= Cap. Gain yield- You need Excel to edit this file

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts