Question: Il. Capital Budgeting Analysis: 4. A real estate developer has projects A and B which are mutually exclusive with the following cash flows: CEL CE2

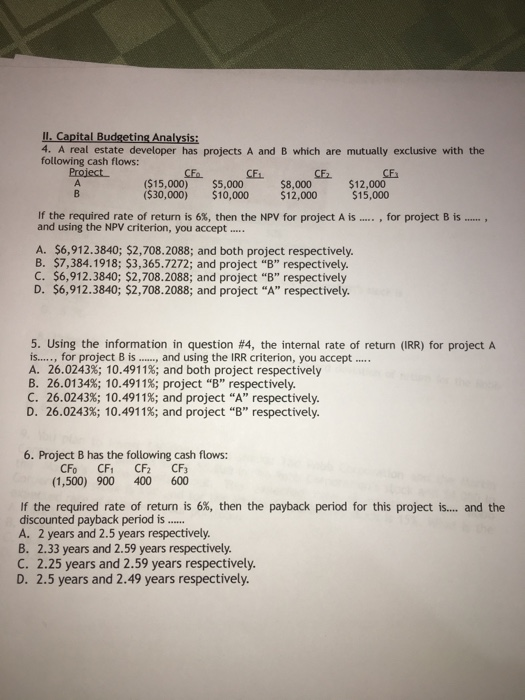

Il. Capital Budgeting Analysis: 4. A real estate developer has projects A and B which are mutually exclusive with the following cash flows: CEL CE2 CF ($15,000) $5,000 ($30,000) 10,000 $8,000 12,000 $12,000 $15,000 If the required rate of return is 6%, then the NPV for project A is , for project B is , and using the NPV criterion, you accept A. $6,912.3840; $2,708.2088; and both project respectively. B. $7,384.1918; $3,365.7272; and project "B" respectively. C. 56,912.3840; $2,708.2088; and project "B" respectively D. $6,912.3840; $2,708.2088; and project "A" respectively. 5. Using the information in question #4, the internal rate of return (IRR) for project A is....., for project B is...., and using the IRR criterion, you accept A, 26.0243% 10.4911%, and both project respectively B. 26.01 34%; 10.4911%; project "B" respectively. C. 26.0243%; 10.4911%; and project "A" respectively. D. 26.0243%; 10.4911%; and project "B" respectively. 6. Project B has the following cash flows: CFo CFi CF2 CF (1,500) 900 400 600 If the required rate of return is 6%, then the payback period for this project is discounted payback period. i.... A. 2 years and 2.5 years respectively. B. 2.33 years and 2.59 years respectively. C. 2.25 years and 2.59 years respectively. D. 2.5 years and 2.49 years respectively. and the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts