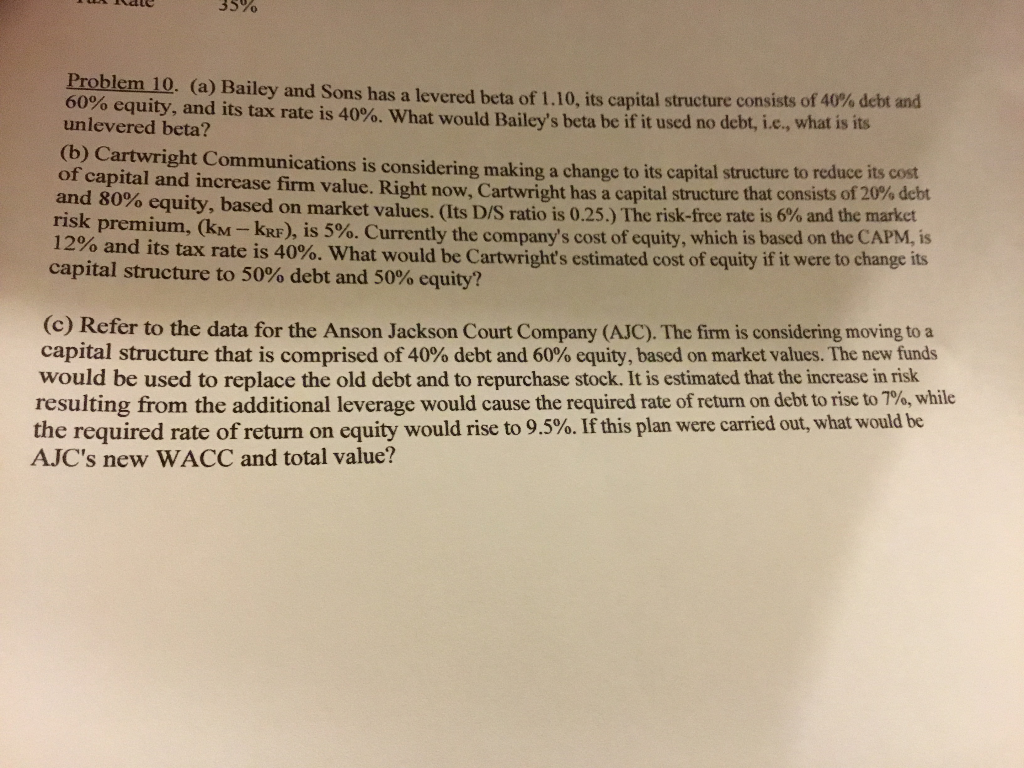

Question: IL Idle 35% Problem 10. (a) Bailey and Sons has a levered beta of 1.10, its capital structure consists of 40% debt and 60% equity,

IL Idle 35% Problem 10. (a) Bailey and Sons has a levered beta of 1.10, its capital structure consists of 40% debt and 60% equity, and its tax rate is 40%. What would Bailey's beta be if it used no debt, 1.e., What is 15 unlevered beta? uy Cartwright Communications is considering making a change to its capital structure to reduce its cost ar and increase firm value. Right now, Cartwright has a capital structure that consists of 20% dcot and 80% equity, based on market values. (Its D/S ratio is 0.25.) The risk-free rate is 6% and the market 15K premium, (KM-KRF), is 5%. Currently the company's cost of equity, which is based on the CAPM, 15 12% and its tax rate is 40%. What would be Cartwright's estimated cost of equity if it were to change its capital structure to 50% debt and 50% equity?! (c) Refer to the data for the Anson Jackson Court Company (AJC). The firm is considering moving to a capital structure that is comprised of 40% debt and 60% equity, based on market values. The new funds would be used to replace the old debt and to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on debt to rise to 7%, while the required rate of return on equity would rise to 9.5%. If this plan were carried out, what would be AJC's new WACC and total value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts