Question: Il Three-Year Returns What is the three-year return on the stock price of the first company (Company A ? How is the stock performing? Ensure

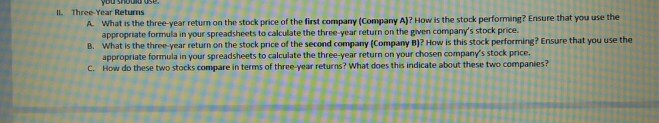

Il Three-Year Returns What is the three-year return on the stock price of the first company (Company A ? How is the stock performing? Ensure that you use the appropriate formula in your spreadsheets to calculate the three-year return on the given company's stock price. what is the three-year return on the stock price of the second company (Company B)? How is this stock performing, Ensure that you use the appropriate formula in your spreadsheets to calculate the three-year return on your chosen company's stock price. How do these two stocks compare in terms of three-year returns? What does this indicate about these two companies? A. B. C.

company A is Microsoft (MSFT) with a three year return of 89.46

company B is Apple (AAPL) with a three year return of 91.79. please answer questions A-C using this data.

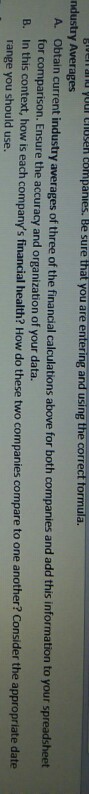

Using the industry averages for Microsoft of 2.5 current ratio, price/earning ratio industry average of 53.43, net profit margin industry average of 6.01% and Apple current ratio industry average of 1.77, price/earning ratio industry average of 15.31, and net profit margin industry average of 17.01% answer the following question B using that data:

Using the free cash flows for 2017 51,147,000, for 2016 53,090,000, and for 2015 86,382,000 for Apple and the 2017 cash flows 31,378,000, for 2016 24,982,000 and 2015 23,136,000 for Microsoft answer the following questions: Il Three-Year Returns What is the three-year return on the stock price of the first company (Company A ? How is the stock performing? Ensure that you use the appropriate formula in your spreadsheets to calculate the three-year return on the given company's stock price. what is the three-year return on the stock price of the second company (Company B)? How is this stock performing, Ensure that you use the appropriate formula in your spreadsheets to calculate the three-year return on your chosen company's stock price. How do these two stocks compare in terms of three-year returns? What does this indicate about these two companies? A. B. C.

Thank you

Il Three-Year Returns What is the three-year return on the stock price of the first company (Company A ? How is the stock performing? Ensure that you use the appropriate formula in your spreadsheets to calculate the three-year return on the given company's stock price. what is the three-year return on the stock price of the second company (Company B)? How is this stock performing, Ensure that you use the appropriate formula in your spreadsheets to calculate the three-year return on your chosen company's stock price. How do these two stocks compare in terms of three-year returns? What does this indicate about these two companies? A. B. C. Il Three-Year Returns What is the three-year return on the stock price of the first company (Company A ? How is the stock performing? Ensure that you use the appropriate formula in your spreadsheets to calculate the three-year return on the given company's stock price. what is the three-year return on the stock price of the second company (Company B)? How is this stock performing, Ensure that you use the appropriate formula in your spreadsheets to calculate the three-year return on your chosen company's stock price. How do these two stocks compare in terms of three-year returns? What does this indicate about these two companies? A. B. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts