Question: ill eate Case Development began operations in December 2021. When property is sold on an installment basis, Case recognizes installment Income for financial reporting purposes

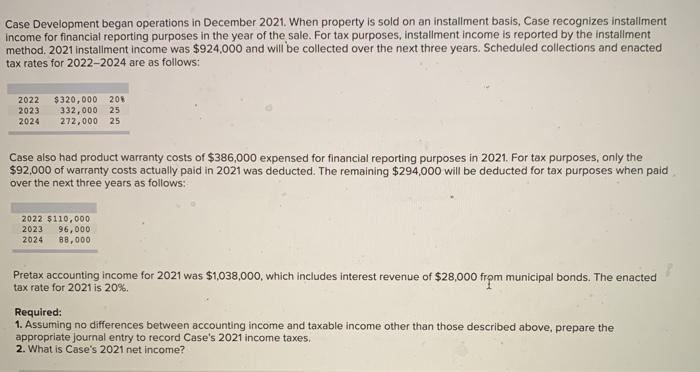

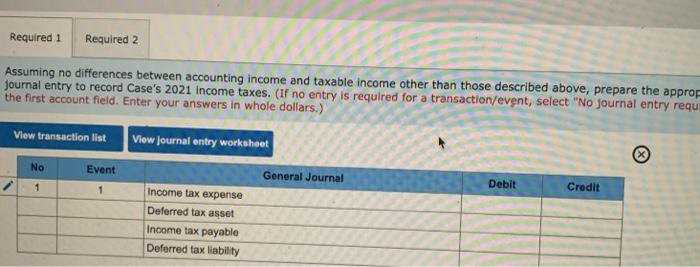

Case Development began operations in December 2021. When property is sold on an installment basis, Case recognizes installment Income for financial reporting purposes in the year of the sale. For tax purposes, installment income is reported by the installment method. 2021 installment income was $924.000 and will be collected over the next three years. Scheduled collections and enacted tax rates for 2022-2024 are as follows: 2022 2023 2024 $320,000 208 332,000 25 272,000 25 Case also had product warranty costs of $386,000 expensed for financial reporting purposes in 2021. For tax purposes only the $92,000 of warranty costs actually paid in 2021 was deducted. The remaining $294.000 will be deducted for tax purposes when paid over the next three years as follows: 2022 $110,000 2023 96,000 2024 88,000 Pretax accounting income for 2021 was $1,038,000, which includes interest revenue of $28,000 from municipal bonds. The enacted tax rate for 2021 is 20% Required: 1. Assuming no differences between accounting income and taxable income other than those described above, prepare the appropriate journal entry to record Case's 2021 income taxes. 2. What is Case's 2021 net income? Required 1 Required 2 Assuming no differences between accounting income and taxable income other than those described above, prepare the approp Journal entry to record Case's 2021 Income taxes. (If no entry is required for a transaction/event, select "No journal entry requi the first account field. Enter your answers in whole dollars.) View transaction list View journal entry workshoet No Event General Journal 1 Debit 1 Credit Income tax expense Deferred tax asset Income tax payable Deferred tax liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts