Question: ill give a good rating if correct, please help! Amiya also had information from the finance group. A colleague in the treasury department informed Amiya

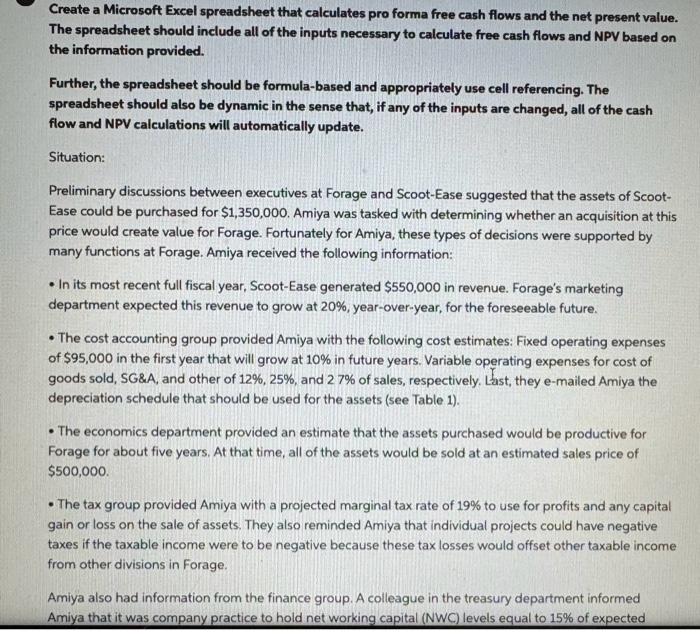

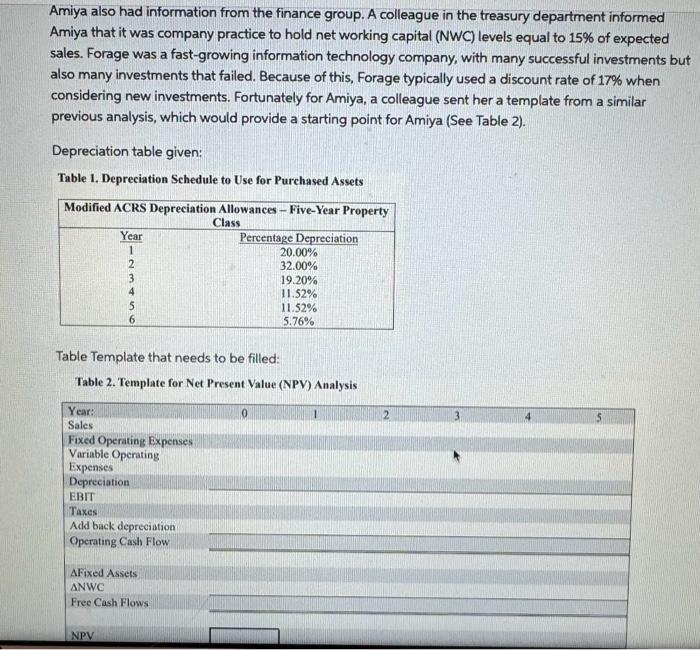

Amiya also had information from the finance group. A colleague in the treasury department informed Amiya that it was company practice to hold net working capital (NWC) levels equal to 15% of expected sales. Forage was a fast-growing information technology company, with many successful investments but also many investments that failed. Because of this, Forage typically used a discount rate of 17% when considering new investments. Fortunately for Amiya, a colleague sent her a template from a similar previous analysis, which would provide a starting point for Amiya (See Table 2). Depreciation table given: Table 1. Depreciation Schedule to Use for Purchased Assets Table Template that needs to be filled: Table 2. Template for Net Present Value (NPV) Analysis Amiya also had information from the finance group. A colleague in the treasury department informed Amiya that it was company practice to hold net working capital (NWC) levels equal to 15% of expected sales. Forage was a fast-growing information technology company, with many successful investments but also many investments that failed. Because of this, Forage typically used a discount rate of 17% when considering new investments. Fortunately for Amiya, a colleague sent her a template from a similar previous analysis, which would provide a starting point for Amiya (See Table 2). Depreciation table given: Table 1. Depreciation Schedule to Use for Purchased Assets Table Template that needs to be filled: Table 2. Template for Net Present Value (NPV) Analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts