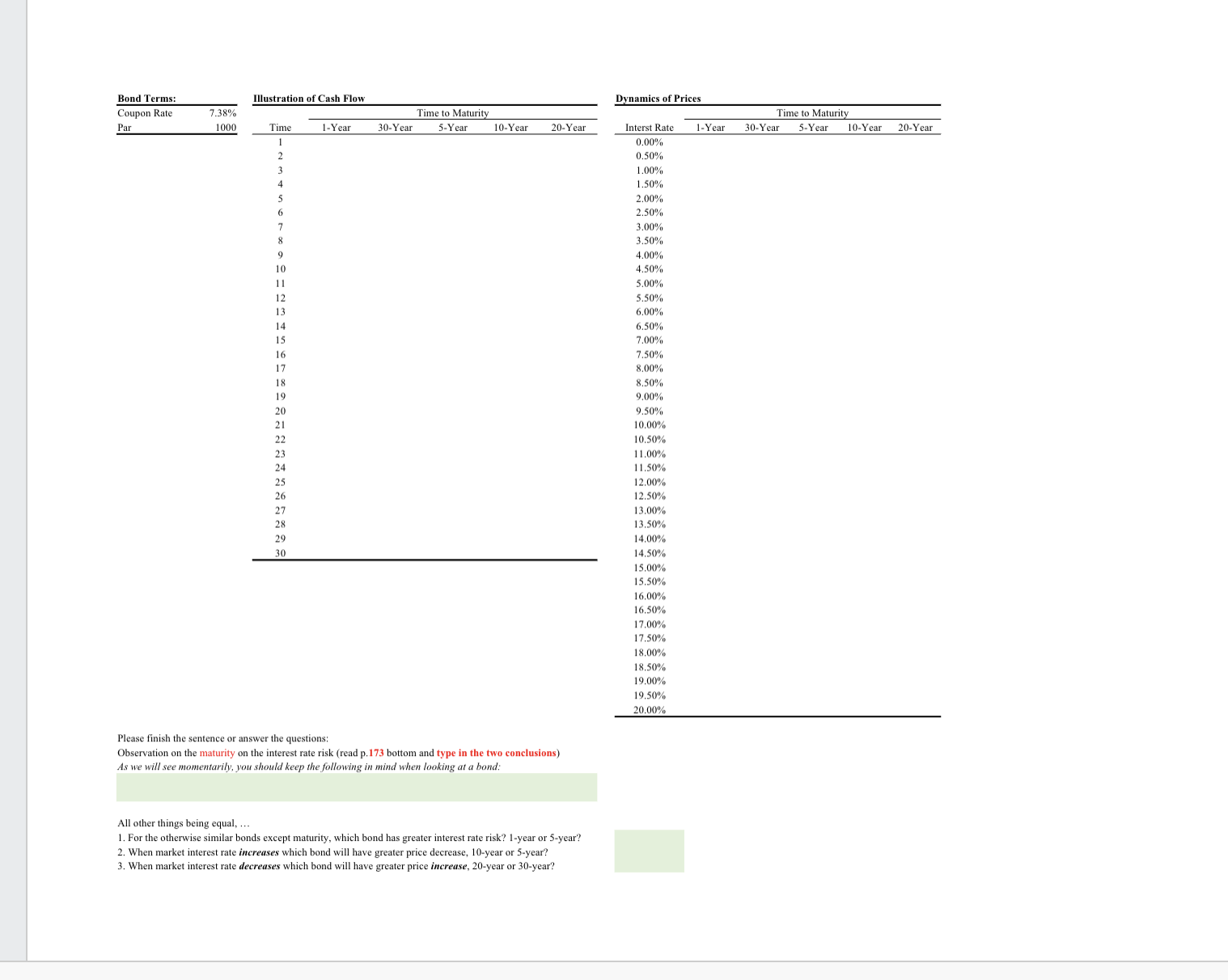

Question: * i'll give a thumbs up * its on a excel sheet... Please finish the sentence or answer the questions: As we will see momentarily,

i'll give a thumbs up its on a excel sheet... Please finish the sentence or answer the questions: As we will see momentarily, you should keep the following in mind when looking at a bond: All other things being equal, For the otherwise similar bonds except maturity, which bond has greater interest rate risk? year or year? Observation on the maturity on the interest rate risk read p bottom and type in the two conclusions When market interest rate increases which bond will have greater price decrease, year or year? When market interest rate decreases which bond will have greater price increase, year or year? Datasheet "Maturity" Requirement In the "Illustration of Cash Flow" part, input the cash flow payoffs for bonds with different maturities. List the cash flows in the column. Cash flows for different bonds should be in different columns. Learnings objective: Create datasheets with columns and simple formulas. Requirement In the "Dynamics of Prices" part, input the prices of bonds with different maturities under different market interest rates. Make sure the formula of bond price is correctly set up Learnings objective: Create datasheets with columns and simple formulas. Utilizes formatting and appropriately complex formulas in a datasheet. Uses a datasheet to summarize information appropriate to the discipline Requirement Use the data from the "Dynamics of Prices" section to draw a graph of bond price against the market interest rates for bonds with different maturities. Learning objective: Uses datasheet functionality graphics to synthesize and evaluate information appropriate to the project Requirement Offer interpretation of data analysis results. Answer the questions at the end of each worksheet. Learning objective: Communicate the academic findings using the academic standard vocabulary. Datasheet "Coupon Rate" Requirement In the "Illustration of Cash Flow" part, input the cash flow payoffs for bonds with different coupon rates. List the cash flows in the column. Cash flows for different bonds should be in different columns. Learnings objective: Create datasheets with columns and simple formulas. Requirement In the "Dynamics of Prices" part, input the prices of bonds with different coupon rates under different market interest rates. Make sure the formula of bond price is correctly set up Learnings objective: Create datasheets with columns and simple formulas. Utilizes formatting and appropriately complex formulas in a datasheet. Uses a datasheet to summarize information appropriate to the discipline Requirement Use the data from the "Dynamics of Prices" section to draw a graph of bond price against the market interest rates for bonds with different coupon rates. Learning objective: Uses datasheet functionality graphics to synthesize and evaluate information appropriate to the project Requirement Offer interpretation of data analysis results Learning objective:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock