Question: I'll thumbs up.. help PROBLEM I: Below is the stockholders equity section of the Withers Corporation balance sheet at the start of business on January

I'll thumbs up.. help

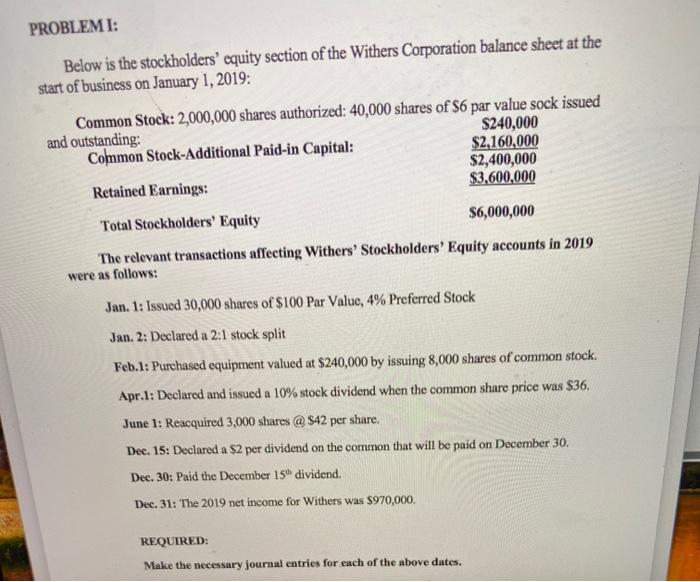

PROBLEM I:

Below is the stockholders equity section of the Withers Corporation balance sheet at the start of business on January 1, 2019:

Common Stock: 2,000,000 shares authorized: 40,000 shares of $6 par value sock issued and outstanding: $240,000

Common Stock-Additional Paid-in Capital: $2,160,000

$2,400,000

Retained Earnings: $3,600,000

Total Stockholders Equity $6,000,000

The relevant transactions affecting Withers Stockholders Equity accounts in 2019 were as follows:

Jan. 1: Issued 30,000 shares of $100 Par Value, 4% Preferred Stock

Jan. 2: Declared a 2:1 stock split

Feb.1: Purchased equipment valued at $240,000 by issuing 8,000 shares of common stock.

Apr.1: Declared and issued a 10% stock dividend when the common share price was $36.

June 1: Reacquired 3,000 shares @ $42 per share.

Dec. 15: Declared a $2 per dividend on the common that will be paid on December 30.

Dec. 30: Paid the December 15th dividend.

Dec. 31: The 2019 net income for Withers was $970,000.

REQUIRED:

Make the necessary journal entries for each of the above dates.

PROBLEM I: Below is the stockholders' equity section of the Withers Corporation balance sheet at the start of business on January 1, 2019: Common Stock: 2,000,000 shares authorized: 40,000 shares of $6 par value sock issued and outstanding: $240,000 Common Stock-Additional Paid-in Capital: $2,160,000 $2,400,000 Retained Earnings: $3,600,000 Total Stockholders' Equity $6,000,000 The relevant transactions affecting Withers' Stockholders' Equity accounts in 2019 were as follows: Jan. 1: Issued 30,000 shares of $100 Par Value, 4% Preferred Stock Jan. 2: Declared a 2:1 stock split Feb.1: Purchased equipment valued at $240,000 by issuing 8,000 shares of common stock. Apr.1: Declared and issued a 10% stock dividend when the common share price was $36. June 1: Reacquired 3,000 shares @ $42 per share. Dec. 15: Declared a $2 per dividend on the common that will be paid on December 30. Dec. 30: Paid the December 15 dividend. Dec. 31: The 2019 net income for Withers was $970,000, REQUIRED: Make the necessary journal entries for each of the above dates. PROBLEM I: Below is the stockholders' equity section of the Withers Corporation balance sheet at the start of business on January 1, 2019: Common Stock: 2,000,000 shares authorized: 40,000 shares of $6 par value sock issued and outstanding: $240,000 Common Stock-Additional Paid-in Capital: $2,160,000 $2,400,000 Retained Earnings: $3,600,000 Total Stockholders' Equity $6,000,000 The relevant transactions affecting Withers' Stockholders' Equity accounts in 2019 were as follows: Jan. 1: Issued 30,000 shares of $100 Par Value, 4% Preferred Stock Jan. 2: Declared a 2:1 stock split Feb.1: Purchased equipment valued at $240,000 by issuing 8,000 shares of common stock. Apr.1: Declared and issued a 10% stock dividend when the common share price was $36. June 1: Reacquired 3,000 shares @ $42 per share. Dec. 15: Declared a $2 per dividend on the common that will be paid on December 30. Dec. 30: Paid the December 15 dividend. Dec. 31: The 2019 net income for Withers was $970,000, REQUIRED: Make the necessary journal entries for each of the above dates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts