Question: _______________________ I'll-8A Explain assumptions and conceptsgoing concern, full disclosure. {L05tAP During the 2008 and 2009 global economic crisis, several large corporations in Canada and the

_______________________

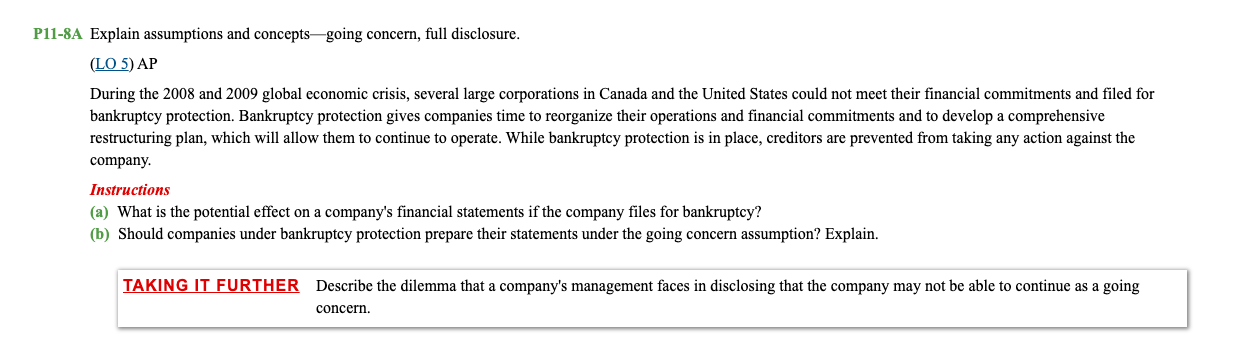

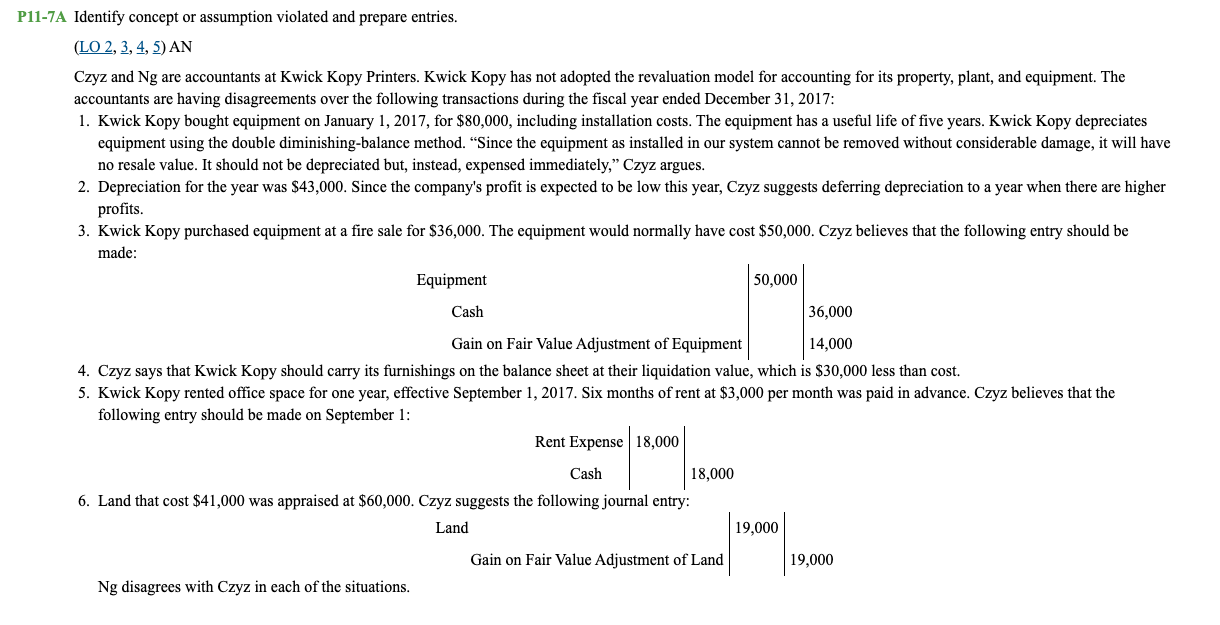

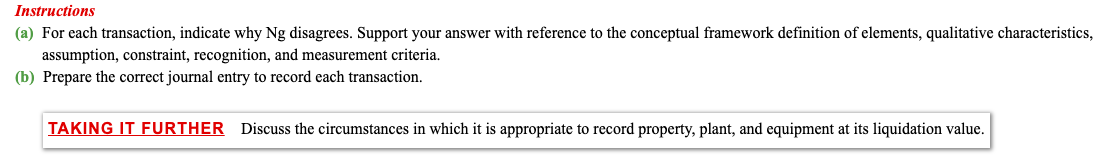

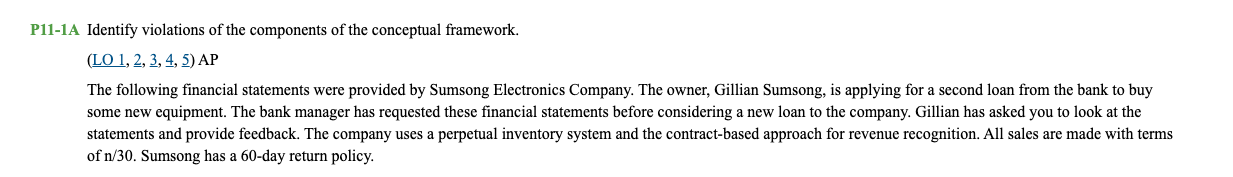

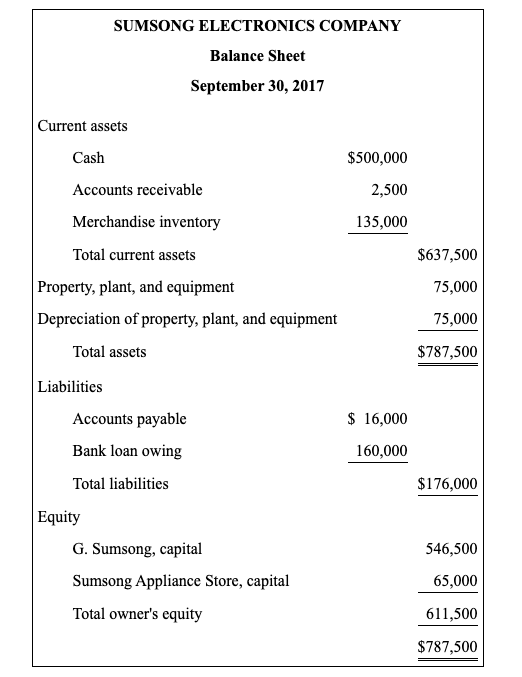

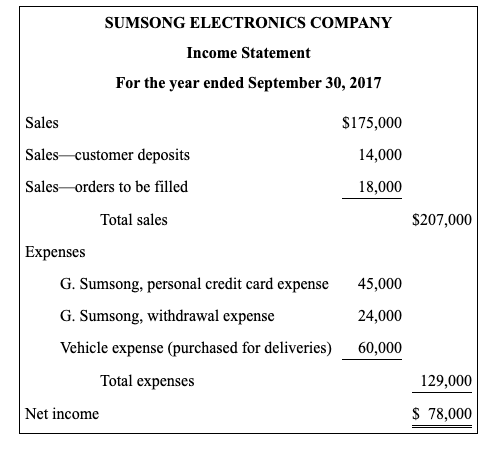

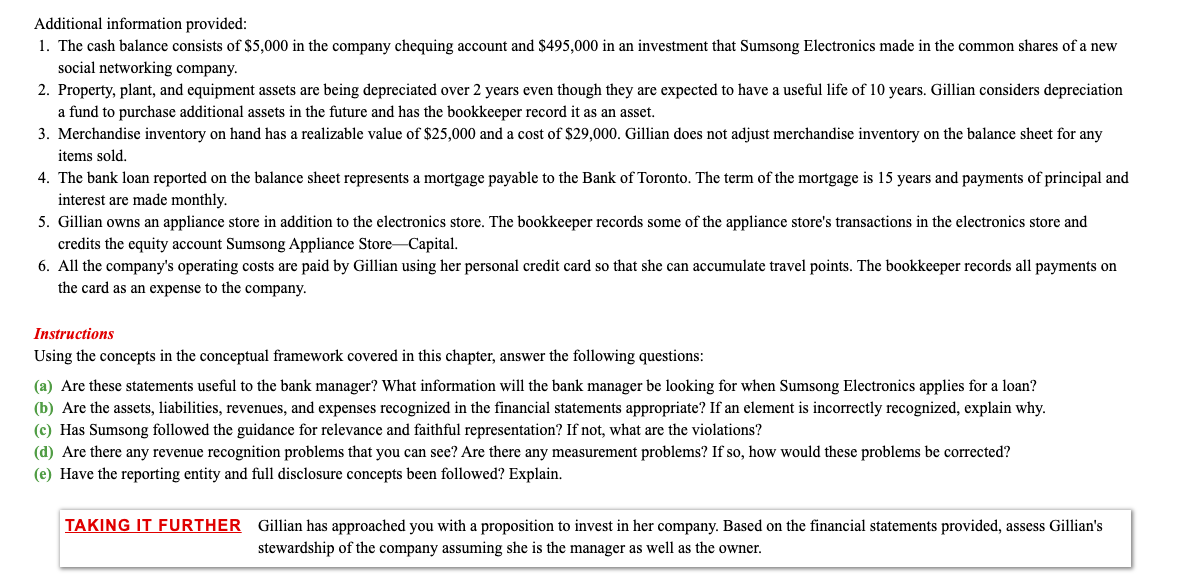

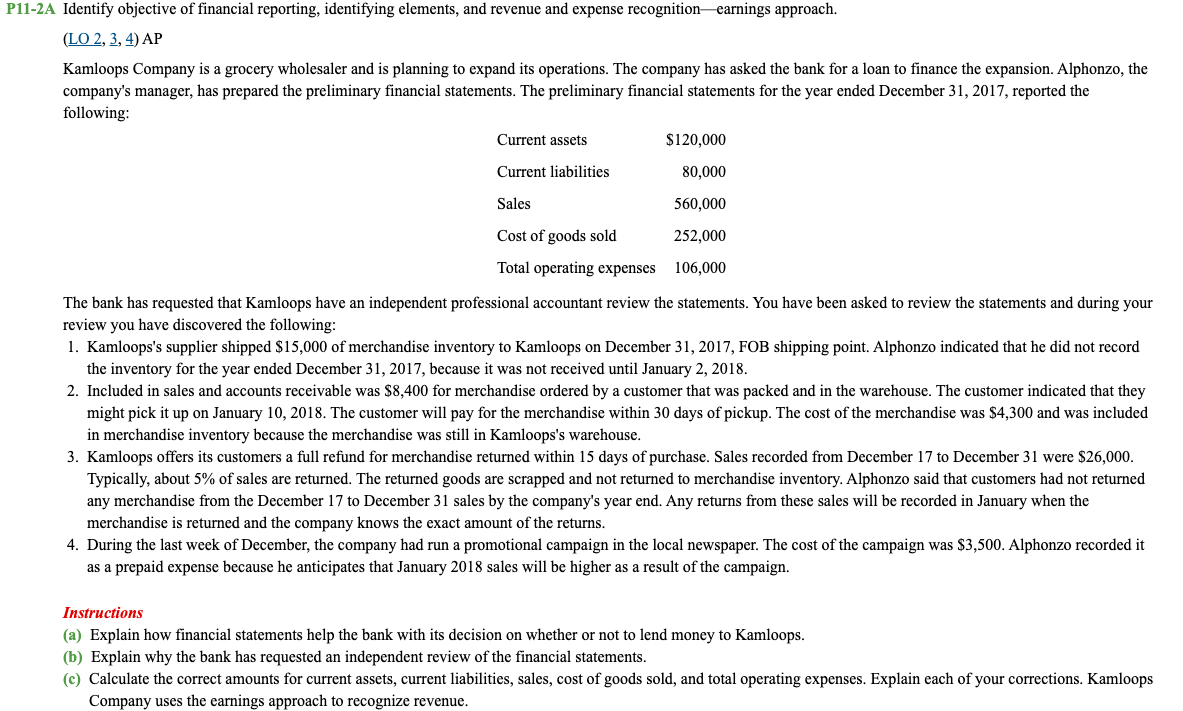

I'll-8A Explain assumptions and conceptsgoing concern, full disclosure. {L05tAP During the 2008 and 2009 global economic crisis, several large corporations in Canada and the United States could not meet their nancial commitments and led for bankruptcy protection. Bankruptcy protection gives companies time to reorganize their operations and nancial commitments and to develop a comprehensive restructuring plan, which will allow them to continue to operate. While bankruptcy protection is in place, creditors are prevented from taking any action against the company. Instructions {3) What is the potential effect on a company's financial statements if the company les for bankruptcy? 01) Should companies under bankruptcy protection prepare their statements under the going concern assumption? Explain. TAKING IT FURTHER Describe the dilemma that a company's management faces in disclosing that the company may not be able to continue as a going concern. P11-7A Identify concept or assumption violated and prepare entries. (LO 2, 3, 4, 5) AN Czyz and Ng are accountants at Kwick Kopy Printers. Kwick Kopy has not adopted the revaluation model for accounting for its property, plant, and equipment. The accountants are having disagreements over the following transactions during the fiscal year ended December 31, 2017: 1. Kwick Kopy bought equipment on January 1, 2017, for $80,000, including installation costs. The equipment has a useful life of five years. Kwick Kopy depreciates equipment using the double diminishing-balance method. "Since the equipment as installed in our system cannot be removed without considerable damage, it will have no resale value. It should not be depreciated but, instead, expensed immediately," Czyz argues. 2. Depreciation for the year was $43,000. Since the company's profit is expected to be low this year, Czyz suggests deferring depreciation to a year when there are higher profits. 3. Kwick Kopy purchased equipment at a fire sale for $36,000. The equipment would normally have cost $50,000. Czyz believes that the following entry should be made: Equipment 50,000 Cash 36,000 Gain on Fair Value Adjustment of Equipment 14,000 4. Czyz says that Kwick Kopy should carry its furnishings on the balance sheet at their liquidation value, which is $30,000 less than cost. 5. Kwick Kopy rented office space for one year, effective September 1, 2017. Six months of rent at $3,000 per month was paid in advance. Czyz believes that the following entry should be made on September 1: Rent Expense 18,000 Cash 18,000 6. Land that cost $41,000 was appraised at $60,000. Czyz suggests the following journal entry: Land 19,000 Gain on Fair Value Adjustment of Land 19,000 Ng disagrees with Czyz in each of the situations.Instructions (a) For each transaction, indicate why Ng disagrees. Support your answer with reference to the conceptual framework definition of elements, qualitative characteristics, assumption, constraint, recognition, and measurement criteria. (b) Prepare the correct journal entry to record each transaction. TAKING IT FURTHER Discuss the circumstances in which it is appropriate to record property, plant, and equipment at its liquidation value.P11-1A Identify violations of the components of the conceptual framework. (LO 1, 2, 3, 4, 5) AP The following financial statements were provided by Sumsong Electronics Company. The owner, Gillian Sumsong, is applying for a second loan from the bank to buy some new equipment. The bank manager has requested these financial statements before considering a new loan to the company. Gillian has asked you to look at the statements and provide feedback. The company uses a perpetual inventory system and the contract-based approach for revenue recognition. All sales are made with terms of n/30. Sumsong has a 60-day return policy.SUMSONG ELECTRONICS COMPANY Balance Sheet September 30, 2017 Current assets Cash $500,000 Accounts receivable 2,500 Merchandise inventory 135,000 Total current assets $637,500 Property, plant, and equipment 75,000 Depreciation of property, plant, and equipment 75,000 Total assets $787,500 Liabilities Accounts payable $ 16,000 Bank loan owing 160,000 Total liabilities $176,000 Equity G. Sumsong, capital 546,500 Sumsong Appliance Store, capital 65,000 Total owner's equity 611,500 $787,500SUMSONG ELECTRONICS COMPANY Income Statement For the year ended September 30, 2017 Sales $175,000 Sales-customer deposits 14,000 Sales-orders to be filled 18,000 Total sales $207,000 Expenses G. Sumsong, personal credit card expense 45,000 G. Sumsong, withdrawal expense 24,000 Vehicle expense (purchased for deliveries) 60,000 Total expenses 129,000 Net income $ 78,000Additional information provided: 1. The cash balance consists of $5,000 in the company chequing account and $495,000 in an investment that Sumsong Electronics made in the common shares of a new social networking company. . Property, plant, and equipment assets are being depreciated over2 years even though they are expected to have a useful life of 10 years. Gillian considers depreciation a fund to purchase additional assets in the future and has the bookkeeper record it as an asset. . Merchandise inventory on hand has a realizable value of $25,000 and a cost of 529,000. Gillian does not adjust merchandise inventory on the balance sheet for any items sold. The bank loan reported on the balance sheet represents a mortgage payable to the Bank of Toronto. The term of the mortgage is 15 years and payments of principal and interest are made monthly. . Gillian owns an appliance store in addition to the electronics store. The bookkeeper records some of the appliance store's transactions in the electronics store and credits the equity account Sumsong Appliance StoreCapital. All the company's operating costs are paid by Gillian using her personal credit card so that she can accumulate travel points. The bookkeeper records all payments on the card as an expense to the company. Instructions Using the concepts in the conceptual framework covered in this chapter, answer the following questions: (a) Are these statements useful to the bank manager? What information will the bank manager be looking for when Sumsong Electronics applies for a loan? (b) Are the assets, liabilities, revenues, and expenses recognized in the financial statements appropriate? If an element is incorrectly recognized, explain why. (1:) Has Sumsong followed the guidance for relevance and faithful representation? [fnot, what are the violations? ((1) Are there any revenue recognition problems that you can see? Are there any measurement problems? If so, how would these problems be corrected? (e) Have the reporting entity and full disclosure concepts been followed? Explain TAKING IT FURTHER Gillian has approached you with a proposition to invest in her company. Based on the nancial statements provided, assess Gillian's stewardship of the company assuming she is the manager as well as the owner. I'll-2A Identify objective of financial reporting, identifying elements, and revenue and expense recognitionearnings approach. (LO 2,;QAP Kamloops Company is a grocery wholesaler and is planning to expand its operations. The company has asked the bank for a loan to nance the expansion. Alphonzo, the company's manager, has prepared the preliminary nancial statements. The preliminary nancial statements for the year ended December 31, 2017, reported the following: Current assets 5 120,000 Current liabilities 80,000 Sales 560,000 Cost of goods sold 252,000 Total operating exp-sea 106,000 The bank has requested that Kamloops have an independent professional accountant review the statements. You have been asked to review the statements and during your review you have discovered the following: 1. Kamloops's supplier shipped $15,000 of merchandise inventory to Kamloops on December 31, 2017, FOB shipping point. Alphonzo indicated that he did not record the inventory for the year ended December 31, 2017, because it was not recein until January 2, 2018. 2. Included in sales and accounts receivable was $8,400 for merchandise ordered by a customer that was packed and in the warehouse. The customer indicated that they might pick it up on January 10, 2018. The customer will pay for the merchandise within 30 days of pickup. The cost of the merchandise was $4,300 and was included in merchandise inventory because the merchandise was still in Kamloops's warehouse. 3. Kamloops offers its customers a full refund for merchandise returned within 15 days of purchase. Sales recorded from December 1? to December 31 were $26,000. Typically, about 5% of sales are retumed. The retumed goods are scrapped and not returned to merchandise inventory. Alphonzo said that customers had not returned any merchandise from the December 1'? to December 31 sales by the company's year end. Any returns from these sales will be recorded in January when the merchandise is returned and the company knows the exact amount of the retums. 4. During the last week of December, the company had run a promotional campaign in the local newspaper. The cost of the campaign was $3,500. Alphonzo recorded it as a prepaid expense because he anticipates that January 2018 sales will be higher as a result of the campaign. Instructions (3) Explain how nancial statements help the bank with its decision on whether or not to lend money to Kamloops. (b) Explain why the bank has requested an independent review of the nancial statements. (c) Calculate the correct amounts for current assets, current liabilities, sales, cost of goods sold, and total operating expenses. Explain each of your corrections. Kamloops Company uses the earnings approach to recognize revenue. TAKING IT FURTHER Calculate the current ratio based on (a) the preliminary financial statements and (b) the corrected amounts. Is the current ratio based on the corrected amounts better or worse? Does there appear to be bias in the types of errors that were made? Explain