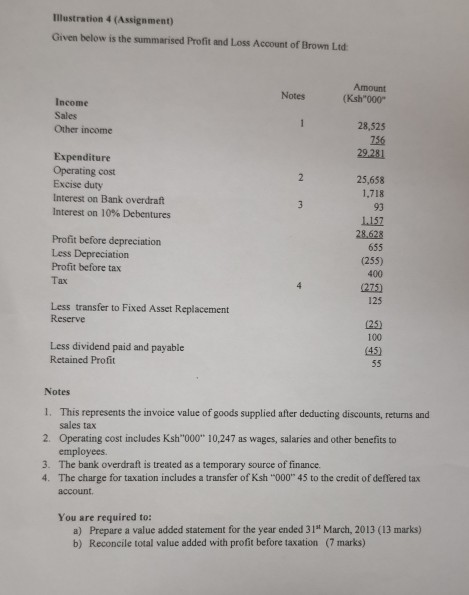

Question: Illustration 4 (Assignment) Given below is the summarised Profit and Loss Account of Brown Ltd Amount (Ksh000 Notes Income Sales Other income 28,525 1% Expenditure

Illustration 4 (Assignment) Given below is the summarised Profit and Loss Account of Brown Ltd Amount (Ksh"000 Notes Income Sales Other income 28,525 1% Expenditure Operating cost Excise duty Interest on Bank overdraft Interest on 10% Debentures 25,658 1,718 93 1157 Profit before depreciation Less Depreciation Profit before tax Tax 655 (255) 400 125 Less transfer to Fixed Asset Replacement 100 Less dividend paid and payable Retained Profit (45) Notes 1. 2. 3. This represents the invoice value of goods supplied after deducting discounts, returns and sales tax Operating cost includes Ksh"000" 10,247 as wages, salaries and other benefits to employees. The bank overdraft is treated as a temporary source of finance. The charge for taxation includes a transfer of Ksh "000" 45 to the credit of deffered tax account. 4 You are required to: a) Prepare a value added statement for the year ended 3 1st March, 2013 (13 marks) b) Reconcile total value added with profit before taxation (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts