Question: ILLUSTRATIVE PROBLEM: CVP ANALYSUS WITH CHANGES IN COST STRUCTURE B. The Don Company sold 100,000 units of its products at P20 per unit. Variable

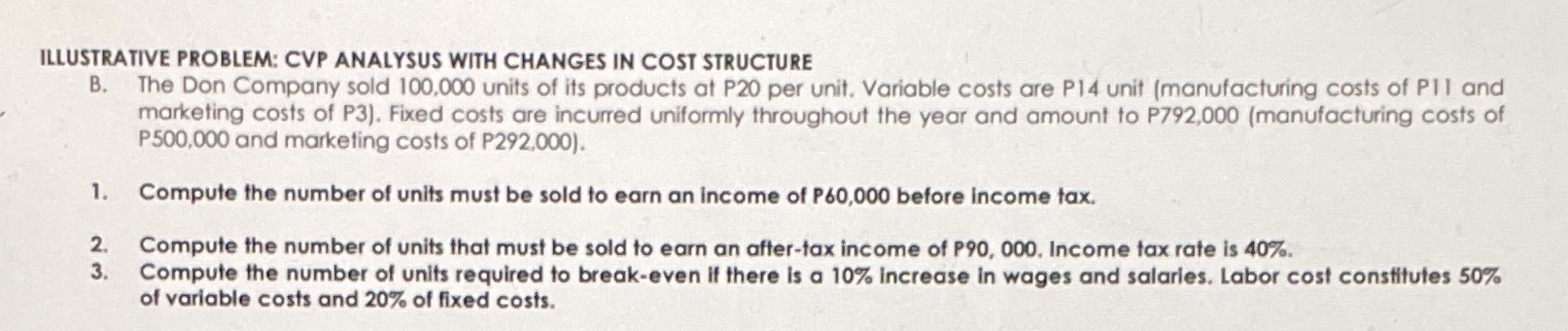

ILLUSTRATIVE PROBLEM: CVP ANALYSUS WITH CHANGES IN COST STRUCTURE B. The Don Company sold 100,000 units of its products at P20 per unit. Variable costs are P14 unit (manufacturing costs of P11 and marketing costs of P3). Fixed costs are incurred uniformly throughout the year and amount to P792,000 (manufacturing costs of P500,000 and marketing costs of P292,000). 1. Compute the number of units must be sold to earn an income of P60,000 before income tax. 2. Compute the number of units that must be sold to earn an after-tax income of P90, 000. Income tax rate is 40%. 3. Compute the number of units required to break-even if there is a 10% increase in wages and salaries. Labor cost constitutes 50% of variable costs and 20% of fixed costs.

Step by Step Solution

3.32 Rating (158 Votes )

There are 3 Steps involved in it

To compute the number of units that must be sold to earn an income of P60000 before income tax we first need to determine the contribution margin per ... View full answer

Get step-by-step solutions from verified subject matter experts