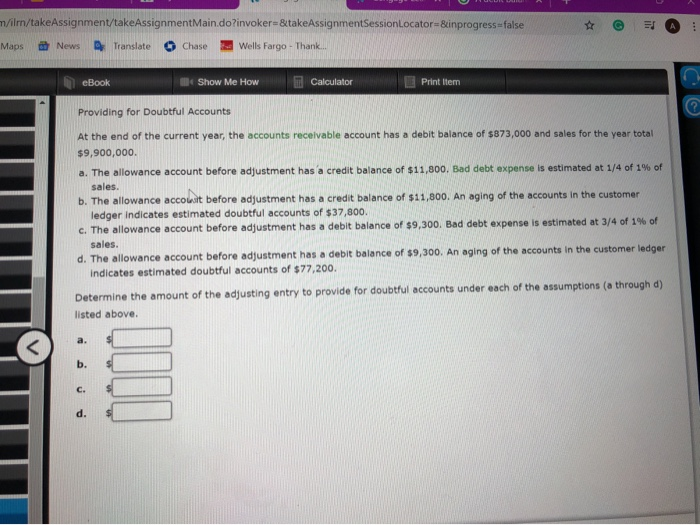

Question: ilm/takeAssignment/take Assignment Main.do?invoker=&takeAssignmentSession Locator=&inprogress=false Maps News Translate O Chase Wells Fargo - Thank * eBook Show Me How Calculator Print Item Providing for Doubtful Accounts

ilm/takeAssignment/take Assignment Main.do?invoker=&takeAssignmentSession Locator=&inprogress=false Maps News Translate O Chase Wells Fargo - Thank * eBook Show Me How Calculator Print Item Providing for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of 5873,000 and sales for the year total $9,900,000. a. The allowance account before adjustment has a credit balance of $11,800. Bad debt expense is estimated at 1/4 of 1% of sales. b. The allowance accouat before adjustment has a credit balance of $11,800. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $37,800. c. The allowance account before adjustment has a debit balance of $9,300. Bad debt expense is estimated at 3/4 of 1% of sales. d. The allowance account before adjustment has a debit balance of $9,300. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $77,200. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above WWW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts